Compare Variman Global with Similar Stocks

Stock DNA

Trading & Distributors

INR 93 Cr (Micro Cap)

43.00

22

0.00%

0.88

5.90%

2.64

Total Returns (Price + Dividend)

Latest dividend: 0.10000000000000002 per share ex-dividend date: Sep-09-2021

Risk Adjusted Returns v/s

Returns Beta

News

Variman Global Enterprises Ltd Stock Hits 52-Week Low Amid Continued Downtrend

Variman Global Enterprises Ltd, a player in the Trading & Distributors sector, has recorded a new 52-week low of Rs.4.52 today, marking a significant decline amid broader market volatility and sectoral underperformance.

Read full news article

Variman Global Enterprises Ltd Falls to 52-Week Low Amid Continued Downtrend

Variman Global Enterprises Ltd has reached a new 52-week low, closing at Rs.4.75 today. This marks a significant decline amid continued underperformance relative to its sector and benchmark indices, reflecting ongoing pressures on the company’s financial metrics and market valuation.

Read full news article

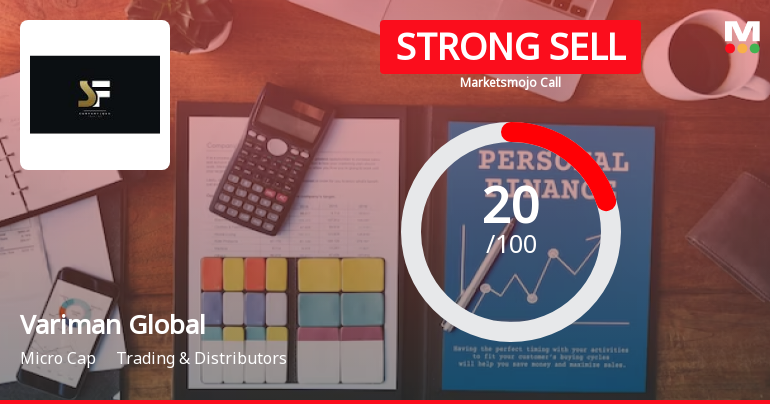

Variman Global Enterprises Ltd is Rated Strong Sell

Variman Global Enterprises Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 09 Sep 2025, reflecting a reassessment of the stock’s outlook. However, the analysis and financial metrics discussed below are based on the company’s current position as of 29 January 2026, providing investors with the latest insights into its performance and prospects.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

28-Jan-2026 | Source : BSEResignation of Company Secretary and Compliance Officer

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

13-Jan-2026 | Source : BSECompliance Certificate under Reg 74 (5) of SEBI (DP) Regulations 2018

Closure of Trading Window

26-Dec-2025 | Source : BSETrading window closure

Corporate Actions

No Upcoming Board Meetings

Variman Global Enterprises Ltd has declared 1% dividend, ex-date: 09 Sep 21

Variman Global Enterprises Ltd has announced 1:10 stock split, ex-date: 11 Aug 22

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

11.061

Held by 0 Schemes

Held by 5 FIIs (1.61%)

Dayata Sirish (19.8%)

Pratik M Sheth (4.38%)

65.0%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -30.25% vs -4.26% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -76.92% vs -81.43% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -2.21% vs -5.58% in Sep 2024

Growth in half year ended Sep 2025 is 247.46% vs -65.90% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 1.31% vs -2.85% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -13.64% vs -14.29% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -4.16% vs -2.35% in Mar 2024

YoY Growth in year ended Mar 2025 is -46.02% vs 17.71% in Mar 2024