Compare Power & Instrum. with Similar Stocks

Dashboard

Healthy long term growth as Net Sales has grown by an annual rate of 40.48% and Operating profit at 50.17%

The company has declared Positive results for the last 7 consecutive quarters

With ROCE of 11.2, it has a Very Attractive valuation with a 1.3 Enterprise value to Capital Employed

Majority shareholders : Non Institution

Below par performance in long term as well as near term

Stock DNA

Other Electrical Equipment

INR 187 Cr (Micro Cap)

14.00

30

0.19%

0.21

9.34%

1.32

Total Returns (Price + Dividend)

Latest dividend: 0.2 per share ex-dividend date: Sep-19-2025

Risk Adjusted Returns v/s

Returns Beta

News

Power & Instrumentation (Gujarat) Ltd Surges to Upper Circuit Amid Robust Buying Pressure

Power & Instrumentation (Gujarat) Ltd surged to its upper circuit limit on 29 Jan 2026, reflecting robust investor demand and significant buying momentum. The stock outperformed its sector and broader market indices, registering a maximum daily gain of 4.99% and triggering a regulatory freeze due to unfilled demand at the price band ceiling.

Read full news article

Power & Instrumentation (Gujarat) Ltd Surges to Upper Circuit on Robust Buying Pressure

Power & Instrumentation (Gujarat) Ltd surged to hit its upper circuit limit on 28 Jan 2026, registering a maximum daily gain of 5.0% to close at ₹103.16. This sharp rally was driven by robust buying interest, a significant rise in delivery volumes, and a notable reversal after two days of decline, signalling renewed investor confidence in this micro-cap electrical equipment player.

Read full news article

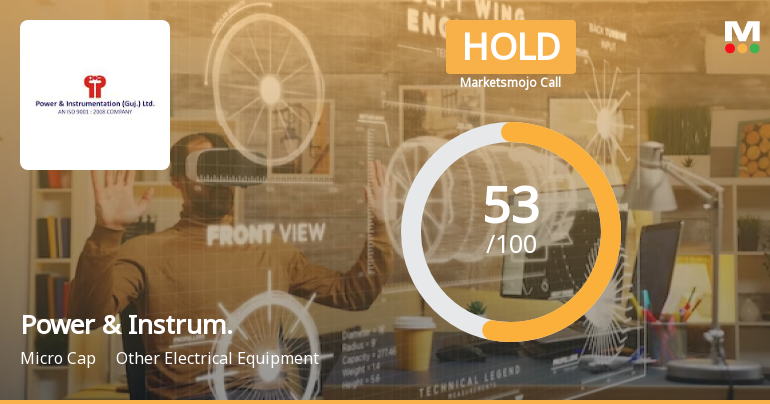

Power & Instrumentation (Gujarat) Ltd is Rated Hold

Power & Instrumentation (Gujarat) Ltd is rated Hold by MarketsMOJO. This rating was last updated on 01 December 2025. However, all fundamentals, returns, and financial metrics discussed here reflect the company’s current position as of 28 January 2026, providing investors with the latest insights into the stock’s performance and outlook.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECertificate under Regulation 74(5) of the SEBI (depositories and Participants) Regualtions 2018 for the quarter ended on December 31 2025

Closure of Trading Window

26-Dec-2025 | Source : BSEIntimation for closure of trading window

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

13-Dec-2025 | Source : BSEPursuant to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we would like to inform that the Company has interacted with Analyst / Institutional Investors on Saturday December 13 2025 at 03:00 P.M. onwards and concluded at 3:55 P.M.

Corporate Actions

No Upcoming Board Meetings

Power & Instrumentation (Gujarat) Ltd has declared 2% dividend, ex-date: 19 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 1 FIIs (0.0%)

Padmaraj Padmnabhan Pillai (18.09%)

Kashee Innovation Llp (2.22%)

41.35%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 27.93% vs 125.77% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 21.08% vs 179.86% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 38.80% vs 73.67% in Sep 2024

Growth in half year ended Sep 2025 is 27.26% vs 141.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 86.16% vs 23.21% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 169.16% vs 32.10% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 73.19% vs 3.43% in Mar 2024

YoY Growth in year ended Mar 2025 is 99.32% vs 62.09% in Mar 2024