Compare Assam Entrade with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 134 Cr (Micro Cap)

84.00

22

0.00%

0.03

2.32%

1.95

Total Returns (Price + Dividend)

Assam Entrade for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

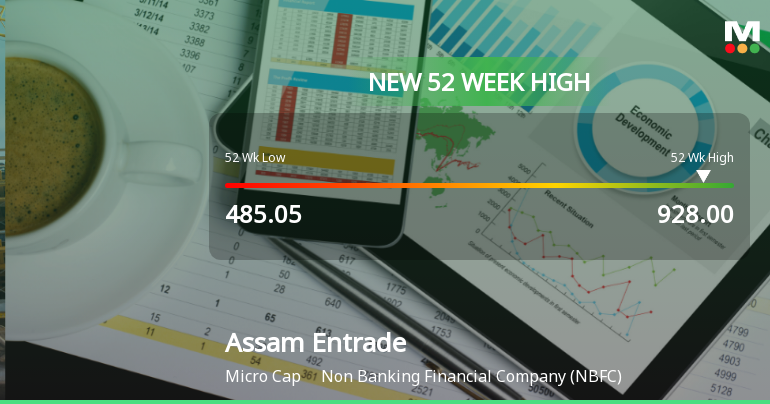

Assam Entrade Ltd Hits New 52-Week High of Rs.928 on 3 Feb 2026

Assam Entrade Ltd, a key player in the Non Banking Financial Company (NBFC) sector, reached a new 52-week high today, touching Rs.928. This milestone underscores the stock’s robust momentum, driven by sustained gains and strong market performance over recent sessions.

Read full news article

Assam Entrade Ltd Hits New 52-Week High of Rs.888 on 2 Feb 2026

Assam Entrade Ltd, a key player in the Non Banking Financial Company (NBFC) sector, reached a new 52-week high of Rs.888 today, underscoring a robust rally and sustained momentum in its share price. This milestone reflects a notable performance trajectory over the past year, significantly outpacing broader market indices and sector benchmarks.

Read full news article

Assam Entrade Ltd is Rated Sell by MarketsMOJO

Assam Entrade Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 15 Oct 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECerificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulation 2018 for the Quarter ended 31st December 2025.

Closure of Trading Window

22-Dec-2025 | Source : BSEWe hereby inform that Pursuant SEBI (Prohibition of Insider Trading) Regulations 2015 as amended from time to time the Trading Window of the Company shall remain closed from Thursday January 01 2026 till the expiry of 48 hrs. after the declaration of Unaudited Standalone and Consolidated Financial Results of the Company fro the Quarter and Nine Months ended December 31 2025.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

12-Dec-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Kiran Gupta

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Dharam Portfolio Private Limited (9.28%)

Shiv Kumar Gupta (8.37%)

35.4%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 23.46% vs -19.00% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -102.08% vs -71.76% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -14.01% vs 27.19% in Sep 2024

Growth in half year ended Sep 2025 is -76.00% vs 471.43% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 29.19% vs 33.07% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 62.65% vs -2.35% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 17.61% vs 25.13% in Mar 2024

YoY Growth in year ended Mar 2025 is 125.37% vs -10.07% in Mar 2024