Compare Regis Industries with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 66 Cr (Micro Cap)

45.00

22

0.00%

0.00

5.48%

2.37

Total Returns (Price + Dividend)

Regis Industries for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

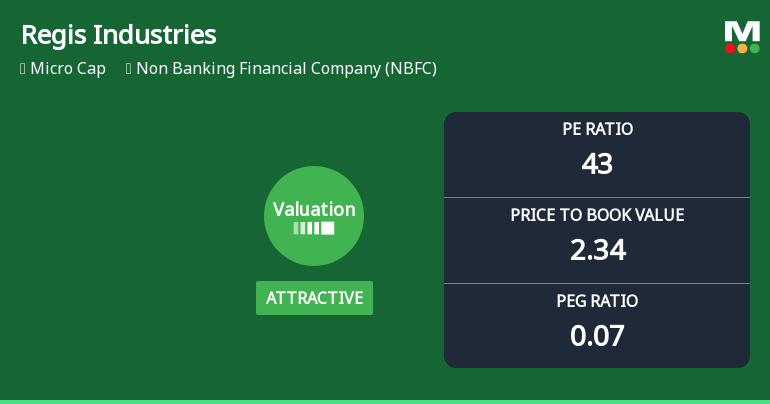

Regis Industries Ltd Valuation Shifts Signal Renewed Price Attractiveness Amid Market Challenges

Regis Industries Ltd, a player in the Non Banking Financial Company (NBFC) sector, has witnessed a notable shift in its valuation parameters, moving from fair to attractive territory. Despite recent share price declines and sector headwinds, the company’s price-to-earnings (P/E) and price-to-book value (P/BV) ratios now present a compelling case for investors seeking value in a challenging market environment.

Read full news article

Regis Industries Ltd is Rated Strong Sell

Regis Industries Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 15 Nov 2025, reflecting a reassessment of the company’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 30 January 2026, providing investors with the latest perspective on the stock’s position.

Read full news article Announcements

Board Meeting Intimation for Compliance Of Regulation 29 Of SEBI (LODR) Regulations 2015 - Intimation Of Board Meeting.

27-Jan-2026 | Source : BSERegis Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve Pursuant to Regulation 29 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we would like to inform you that a meeting of the Board of Directors of the Company will be held on Tuesday 10th February 2026 inter alia to consider following businesses: - 1.) To approve and take on record the Un-Audited Financial Results of the Company for the quarter and nine months ended as on 31st December 2025. 2.) Any other matter with the permission of the board which the Board may think fit. Please take the above intimation in your records. Thanking You.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Jan-2026 | Source : BSEPFA

Closure of Trading Window

20-Dec-2025 | Source : BSEPFA

Corporate Actions

10 Feb 2026

No Dividend history available

Regis Industries Ltd has announced 1:10 stock split, ex-date: 16 Jan 25

Regis Industries Ltd has announced 1:2 bonus issue, ex-date: 12 Sep 25

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

None

Strategic Shares Solutions Private Limited (10.14%)

12.79%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -80.50% vs 320.90% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -97.39% vs 212.24% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -67.75% vs 69.43% in Sep 2024

Growth in half year ended Sep 2025 is 660.71% vs 69.57% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 96.79% vs -72.87% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 33.33% vs -173.33% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 4.67% vs -47.94% in Mar 2024

YoY Growth in year ended Mar 2025 is 64.52% vs -181.82% in Mar 2024