Compare Bonlon Industrie with Similar Stocks

Stock DNA

Non - Ferrous Metals

INR 76 Cr (Micro Cap)

27.00

27

0.00%

0.31

3.39%

0.96

Total Returns (Price + Dividend)

Bonlon Industrie for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Bonlon Industries Ltd is Rated Sell

Bonlon Industries Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 18 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 30 January 2026, providing investors with the most up-to-date insight into the company’s performance and outlook.

Read full news article

Bonlon Industries Ltd is Rated Sell

Bonlon Industries Ltd is rated Sell by MarketsMOJO, with this rating last updated on 18 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 19 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

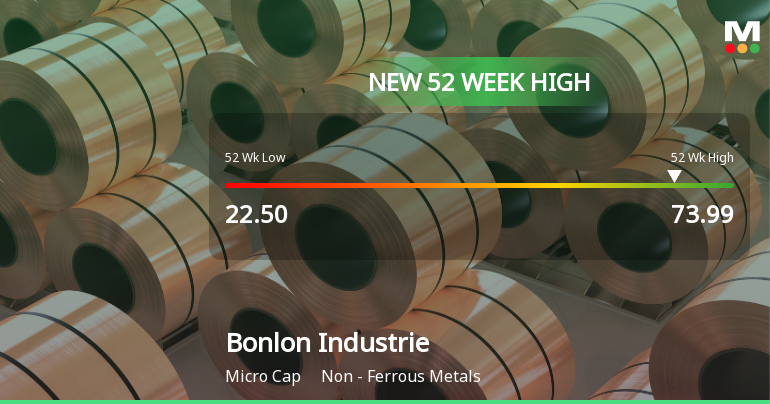

Bonlon Industries Ltd Hits New 52-Week High at Rs.73.99

Bonlon Industries Ltd, a key player in the Non-Ferrous Metals sector, reached a significant milestone today by hitting a new 52-week high of Rs.73.99. This achievement marks a continuation of the stock’s strong upward momentum over the past year, reflecting robust market performance despite sectoral headwinds.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

24-Jan-2026 | Source : BSEThe Company has submitted the Compliance Certificate for quarter ended 31.12.2025.

Board Meeting Outcome for OUTCOME OF BOARD MEETING

24-Jan-2026 | Source : BSEThe Company has informed the BSE that a Board Meeting was held today at the registered office of the Company. The Company has submitted the outcome of Board Meeting to BSE.

Announcement under Regulation 30 (LODR)-Change in Directorate

24-Jan-2026 | Source : BSEThe Company has informed the BSE regarding change in Independent Directors of the Company.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Arun Kumar Jain (46.2%)

Rishabh Pant (4.57%)

29.68%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 34.22% vs 23.43% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -159.38% vs 730.23% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Nine Monthly Results Snapshot (Consolidated) - Dec'24

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 44.41% vs 172.78% in Mar 2024

YoY Growth in year ended Mar 2025 is 15.02% vs 18.27% in Mar 2024