Compare Krishna Institu. with Similar Stocks

Total Returns (Price + Dividend)

Krishna Institu. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Krishna Institute of Medical Sciences Ltd is Rated Sell

Krishna Institute of Medical Sciences Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 11 February 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 06 March 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

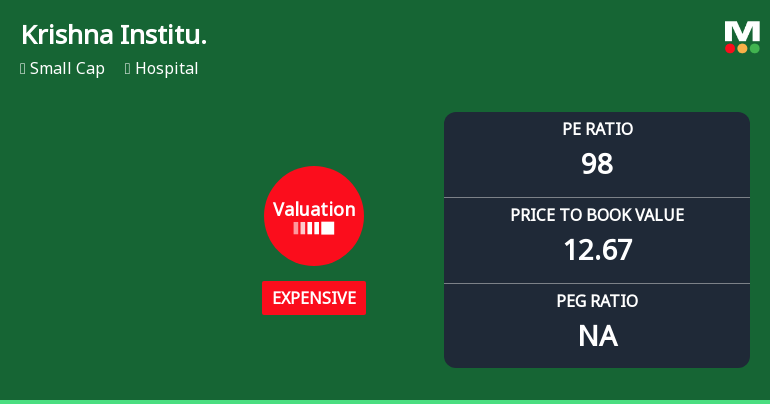

Krishna Institute of Medical Sciences Ltd: Valuation Shifts Signal Price Attractiveness Change

Krishna Institute of Medical Sciences Ltd (KIMS) has experienced a notable shift in its valuation parameters, moving from a very expensive to an expensive rating. This change, reflected in key metrics such as the price-to-earnings (P/E) and price-to-book value (P/BV) ratios, signals a subtle recalibration in the stock’s price attractiveness amid a challenging hospital sector landscape. Investors should weigh these valuation dynamics against the company’s operational performance and peer comparisons to assess its market positioning.

Read full news article

Krishna Institute of Medical Sciences Ltd Opens with Sharp Gap Down Amid Market Concerns

Krishna Institute of Medical Sciences Ltd (KIMS) commenced trading today with a significant gap down, opening at a price 11.88% lower than its previous close. This weak start reflects heightened market concerns, resulting in notable intraday volatility and a cautious trading environment for the hospital sector stock.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

20-Feb-2026 | Source : BSEChasing Growth 2026 investors conference organized by Kotak Securities

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

16-Feb-2026 | Source : BSELion Global Investors-Conference

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

13-Feb-2026 | Source : BSETranscript of earnings call held on 09.02.2026

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Krishna Institute of Medical Sciences Ltd has announced 2:10 stock split, ex-date: 13 Sep 24

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

3.6633

Held by 26 Schemes (27.5%)

Held by 159 FIIs (14.33%)

Bhaskara Rao Bollineni (26.27%)

Sbi Small Cap Fund (5.96%)

11.76%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 3.85% vs 10.22% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -20.18% vs -14.89% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 25.01% vs 16.46% in Sep 2024

Growth in half year ended Sep 2025 is -25.00% vs 12.25% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 26.45% vs 20.05% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -29.64% vs 15.54% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 21.49% vs 13.67% in Mar 2024

YoY Growth in year ended Mar 2025 is 24.03% vs -7.83% in Mar 2024