Compare Piramal Pharma with Similar Stocks

Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.83 times

- Poor long term growth as Net Sales has grown by an annual rate of 7.96% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.83 times

- The company has been able to generate a Return on Equity (avg) of 0.32% signifying low profitability per unit of shareholders funds

The company has declared Negative results for the last 3 consecutive quarters

Below par performance in long term as well as near term

Stock DNA

Pharmaceuticals & Biotechnology

INR 20,610 Cr (Small Cap)

NA (Loss Making)

33

0.06%

0.51

-0.55%

2.55

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Jul-16-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Piramal Pharma Ltd latest results good or bad?

Piramal Pharma Ltd's latest financial results for Q3 FY26 reveal significant operational challenges. The company reported a consolidated net loss of ₹136.19 crores, marking a substantial decline compared to the previous year. Revenue for the quarter was ₹2,139.87 crores, reflecting a year-on-year decrease of 2.92%, although there was a sequential growth of 4.70% from the previous quarter. This indicates a concerning trend of weakening demand across its key business segments, which include contract development and manufacturing, complex hospital generics, and India consumer healthcare. The operating margin (excluding other income) fell to 9.15%, down from 15.32% in the same quarter last year, highlighting severe margin compression. The profit before tax also turned negative, with a loss of ₹93.86 crores compared to a profit in the previous year. Employee costs have risen, reflecting ongoing investment in ta...

Read full news article

Piramal Pharma Q3 FY26: Losses Deepen as Operational Challenges Mount

Piramal Pharma Ltd. reported a consolidated net loss of ₹136.19 crores for Q3 FY26, marking a dramatic deterioration from the ₹3.68 crores profit posted in the same quarter last year. The loss widened 37.26% sequentially from Q2 FY26's ₹99.22 crores, highlighting deepening operational challenges at the ₹20,610 crores market capitalisation pharmaceutical company. The stock tumbled 3.18% to ₹159.15 following the results announcement, reflecting investor concerns over persistent profitability pressures despite modest revenue growth.

Read full news article

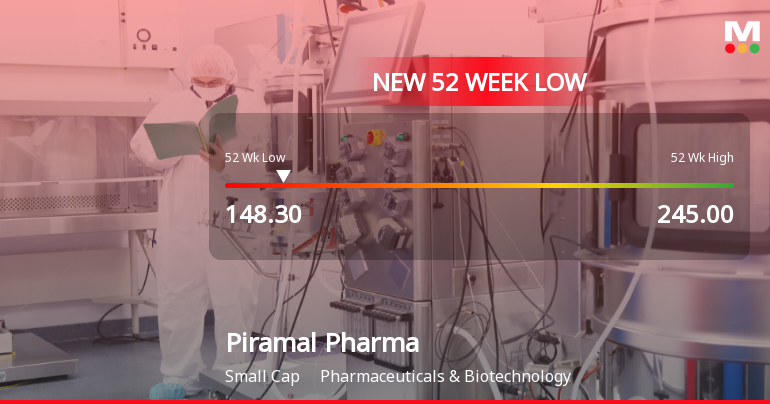

Piramal Pharma Ltd Stock Falls to 52-Week Low of Rs.148.3

Piramal Pharma Ltd’s shares touched a new 52-week low of Rs.148.3 today, marking a significant decline amid a challenging year for the pharmaceutical company. Despite a modest recovery over the past three days, the stock remains under pressure, reflecting ongoing concerns about its financial performance and valuation metrics.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

21-Jan-2026 | Source : BSEIntimation of Schedule of Analyst/ Institutional Investor Meetings under the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

16-Jan-2026 | Source : BSEPursuant to Regulation 30(6) of the SEBI Listing Regulations please find enclosed herewith the details of the Conference Call with investors/ analysts.

Board Meeting Intimation for Considering And Approving The Unaudited Financial Results (Standalone And Consolidated) Of The Company For Quarter And Nine Months Ended 31St December 2025.

16-Jan-2026 | Source : BSEPiramal Pharma Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 28/01/2026 inter alia to consider and approve the Unaudited Financial Results (Standalone and Consolidated) of the Company for quarter and nine months ended 31st December 2025.

Corporate Actions

No Upcoming Board Meetings

Piramal Pharma Ltd has declared 1% dividend, ex-date: 16 Jul 25

No Splits history available

No Bonus history available

Piramal Pharma Ltd has announced 5:46 rights issue, ex-date: 02 Aug 23

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 27 Schemes (14.03%)

Held by 173 FIIs (29.66%)

The Sri Krishna Trust Through Its Trustee Mr. Ajay G Piramal And Dr. (mrs.) Swati A Piramal (26.55%)

Ca Alchemy Investments (17.95%)

14.11%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 4.70% vs 5.69% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -37.26% vs -21.44% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -5.14% vs 14.55% in Sep 2024

Growth in half year ended Sep 2025 is -173.91% vs 29.40% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -4.37% vs 13.85% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -408.43% vs 25.26% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 11.99% vs 15.39% in Mar 2024

YoY Growth in year ended Mar 2025 is 411.39% vs 109.56% in Mar 2024