Compare Jupiter Wagons with Similar Stocks

Dashboard

With a fall in Net Sales of -11.27%, the company declared Very Negative results in Sep 25

- The company has declared negative results for the last 2 consecutive quarters

- PAT(Latest six months) At Rs 86.20 cr has Grown at -52.55%

- PBT LESS OI(Q) At Rs 68.03 cr has Fallen at -25.8% (vs previous 4Q average)

- NET SALES(Latest six months) At Rs 1,245.19 cr has Grown at -34.08%

With ROE of 10.3, it has a Very Expensive valuation with a 5 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Industrial Manufacturing

INR 13,746 Cr (Small Cap)

48.00

37

0.31%

0.02

10.28%

4.96

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: May-30-2025

Risk Adjusted Returns v/s

Returns Beta

News

Jupiter Wagons Ltd Valuation Shifts to Very Expensive Amid Mixed Returns

Jupiter Wagons Ltd has seen a marked shift in its valuation parameters, moving from an already expensive rating to a very expensive classification. This change, driven by rising price-to-earnings (P/E) and price-to-book value (P/BV) ratios, raises questions about the stock’s price attractiveness relative to its historical averages and peer group within the industrial manufacturing sector.

Read full news article

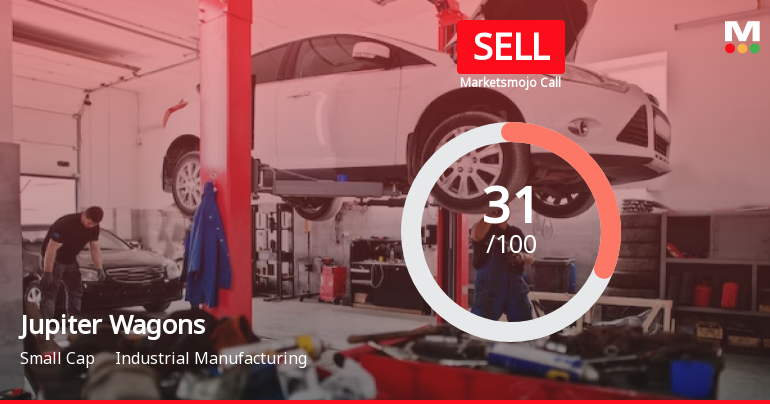

Jupiter Wagons Ltd is Rated Sell

Jupiter Wagons Ltd is rated Sell by MarketsMOJO, with this rating last updated on 14 January 2026. However, the analysis and financial metrics discussed here reflect the company’s current position as of 23 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Jupiter Wagons Ltd Valuation Shifts to Very Expensive Amid Mixed Market Returns

Jupiter Wagons Ltd, a key player in the industrial manufacturing sector, has witnessed a marked shift in its valuation parameters, moving from an already expensive rating to a very expensive category. This change reflects a significant deterioration in price attractiveness, driven by elevated price-to-earnings (P/E) and price-to-book value (P/BV) ratios relative to both its historical averages and peer group benchmarks.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

22-Jan-2026 | Source : BSEPlease find the enclosed newspaper publication.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

21-Jan-2026 | Source : BSEPlease find the enclosed Postal Ballot Notice dated 15.12.2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSEPlease find the enclosed certificate under SEBI (DP) Regulations for the quarter ended 31.12.2025.

Corporate Actions

No Upcoming Board Meetings

Jupiter Wagons Ltd has declared 10% dividend, ex-date: 30 May 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Jan 2026

Shareholding Compare (%holding)

Promoters

None

Held by 17 Schemes (0.73%)

Held by 92 FIIs (4.49%)

Karisma Goods Private Limited (0.21%)

Gothic Corporation (0.031%)

14.93%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 71.08% vs -56.03% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 42.39% vs -68.33% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -34.08% vs 15.71% in Sep 2024

Growth in half year ended Sep 2025 is -56.37% vs 25.34% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 15.44% vs 86.38% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 23.24% vs 177.53% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 8.77% vs 76.17% in Mar 2024

YoY Growth in year ended Mar 2025 is 15.29% vs 174.49% in Mar 2024