Key Events This Week

27 Jan: Stock rallies 3.56% amid mixed technical signals

28 Jan: Strong quarterly results and significant gap up open

29 Jan: Sharp 6.47% decline despite positive valuation shift

30 Jan: Recovery with 2.05% gain closes the week

Feb 01

BSE+NSE Vol: 2.76 lacs

Gems, Jewellery And Watches

INR 3,733 Cr (Small Cap)

18.00

47

2.68%

-0.02

12.66%

2.58

Latest dividend: 1.5 per share ex-dividend date: Nov-06-2025

27 Jan: Stock rallies 3.56% amid mixed technical signals

28 Jan: Strong quarterly results and significant gap up open

29 Jan: Sharp 6.47% decline despite positive valuation shift

30 Jan: Recovery with 2.05% gain closes the week

Vaibhav Global Ltd has declared a dividend. Dividend Details: - Percentage announced: 75% - Amount per share: 1.5 - Ex-date: 03 Feb 26 Dividend Yield: 2.72%. Total Returns by Period: In the last 3 months, the price return was -18.42%, the dividend return was 1.07%, resulting in a total return of -17.35%. In the last 6 months, the price return was -4.61%, the dividend return was 1.98%, leading to a total return of -2.63%. Over the past year, the price return was -20.12%, the dividend return was 2.75%, culminating in a total return of -17.37%. In the last 2 years, the price return was -57.15%, the dividend return was 2.40%, which resulted in a total return of -54.75%. For the last 3 years, the price return was -25.31%, the dividend return was 5.19%, giving a total return of -20.12%. In the last 4 years, the price return was -51.8%, the dividend return was 5.50%, resulting in a total return of -46.3%. ...

Read full news article

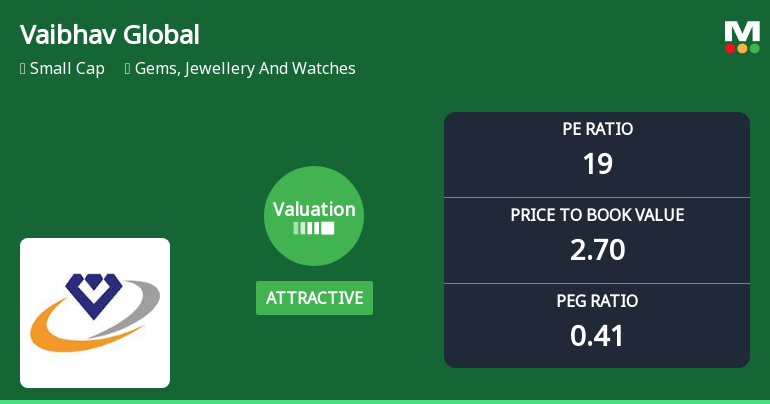

Vaibhav Global Ltd has witnessed a notable improvement in its valuation parameters, shifting from a very attractive to an attractive rating, signalling a more favourable price point for investors. Despite this positive change, the company’s stock performance over various time horizons remains mixed when compared with the broader Sensex index, underscoring the need for a nuanced analysis of its valuation and market positioning within the Gems, Jewellery and Watches sector.

Read full news articleNewspaper Publication - Financial Results of Q3 & 9M FY 2026

As enclosed.

Investor Presentation of Q3 & 9M FY26

No Upcoming Board Meetings

Vaibhav Global Ltd has declared 75% dividend, ex-date: 03 Feb 26

Vaibhav Global Ltd has announced 2:10 stock split, ex-date: 07 May 21

No Bonus history available

No Rights history available

Promoters

None

Held by 5 Schemes (0.12%)

Held by 88 FIIs (18.05%)

Brett Enterprises Private Limited (55.65%)

Nalanda India Fund Limited (7.57%)

19.62%

YoY Growth in quarter ended Dec 2025 is 9.07% vs 10.02% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 40.71% vs 34.56% in Dec 2024

Growth in half year ended Sep 2025 is 8.93% vs 13.88% in Sep 2024

Growth in half year ended Sep 2025 is 53.63% vs -6.10% in Sep 2024

YoY Growth in nine months ended Dec 2025 is 8.98% vs 12.36% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 46.72% vs 12.01% in Dec 2024

YoY Growth in year ended Mar 2025 is 11.14% vs 13.01% in Mar 2024

YoY Growth in year ended Mar 2025 is 19.90% vs 21.87% in Mar 2024