Compare Stanpacks(India) with Similar Stocks

Dashboard

High Debt company with Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 3.52% and Operating profit at 3.37% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 2.64 times

- The company has been able to generate a Return on Equity (avg) of 1.85% signifying low profitability per unit of shareholders funds

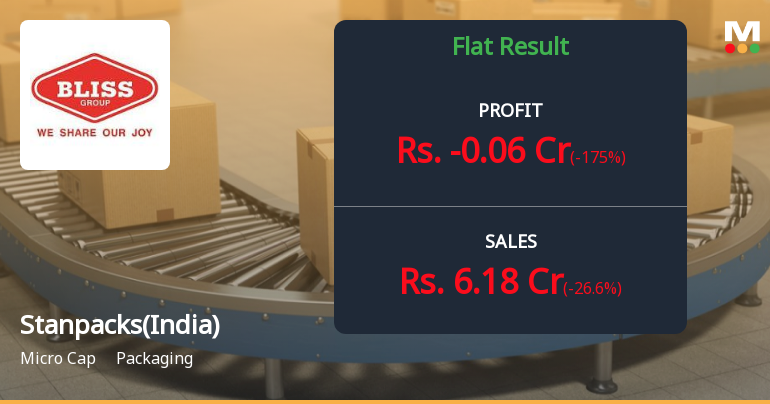

Flat results in Dec 25

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 0.5000 per share ex-dividend date: Sep-18-2006

Risk Adjusted Returns v/s

Returns Beta

News

Are Stanpacks (India) Ltd latest results good or bad?

The latest financial results for Stanpacks (India) Ltd for Q3 FY26 indicate significant operational challenges. The company reported a net loss of ₹0.06 crores, contrasting sharply with a profit of ₹0.08 crores in the previous quarter. Revenue also saw a notable decline, falling to ₹6.18 crores, which represents a 26.60% decrease from ₹8.42 crores in Q2 FY26 and a 7.49% drop year-on-year from ₹6.68 crores in Q3 FY25. This decline in sales marks one of the weakest performances in recent history, raising concerns about demand within the packaging sector and the company's competitive positioning. Operating margins contracted to 3.88%, down from 4.51% in the previous quarter, reflecting pressures from both revenue decline and rising operational costs. The PAT margin turned negative at -0.97%, a shift from a positive margin of 0.95% in Q2 FY26. Elevated employee costs, which accounted for a larger percentage of...

Read full news article

Stanpacks (India) Q3 FY26: Losses Deepen Amid Revenue Decline and Margin Pressure

Stanpacks (India) Ltd., a Chennai-based packaging company and part of the BLISS Group, reported a troubling third quarter for FY2026, slipping into net losses of ₹0.06 crores compared to a modest profit of ₹0.08 crores in Q2 FY26. The micro-cap company, with a market capitalisation of just ₹7.00 crores, saw its shares decline 4.89% to ₹11.67 following the results announcement, reflecting investor concerns about deteriorating operational performance and persistent margin challenges.

Read full news article

Stanpacks (India) Ltd Upgraded to Sell on Technical Improvements Despite Lingering Fundamental Concerns

Stanpacks (India) Ltd has seen its investment rating upgraded from Strong Sell to Sell as of 28 Jan 2026, driven primarily by a shift in technical indicators. Despite this upgrade, the company continues to face challenges in its fundamental and financial metrics, reflecting a cautious outlook for investors in the packaging sector.

Read full news article Announcements

Board Meeting Outcome for Board Meeting Outcome -Unaudited Financial Results Of The Company For The Quarter 31St December 2025

31-Jan-2026 | Source : BSEBoard Meeting Outcome -Unaudited Financial Results Of The Company For The Quarter 31st December 2025

Board Meeting Intimation for To Consider And To Take On Record The Unaudited Financial Results For The Quarter Ended 31St December 2025

09-Jan-2026 | Source : BSEStanpacks India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 31/01/2026 inter alia to consider and approve the Unaudited Financial Results for the quarter ended 31st December 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECertificate under Reg. 74(5) of SEBI(Depositories and Participants) Regulation 2018 for the quarter ended 31st December 2025.

Corporate Actions

No Upcoming Board Meetings

Stanpacks (India) Ltd has declared 5% dividend, ex-date: 18 Sep 06

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 1 Schemes (1.44%)

Held by 0 FIIs

Balaji Trading Enterprises Pvt Ltd (21.25%)

Muralidhar G (4.86%)

55.9%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -26.60% vs 8.93% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -175.00% vs 166.67% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 8.24% vs -2.29% in Sep 2024

Growth in half year ended Sep 2025 is -15.38% vs 176.47% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 3.38% vs 2.81% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -70.59% vs 151.52% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 6.72% vs -5.39% in Mar 2024

YoY Growth in year ended Mar 2025 is -55.56% vs 116.27% in Mar 2024