Compare Lambodhara Text. with Similar Stocks

Stock DNA

Garments & Apparels

INR 117 Cr (Micro Cap)

14.00

20

0.45%

0.07

6.62%

0.95

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Sep-15-2025

Risk Adjusted Returns v/s

Returns Beta

News

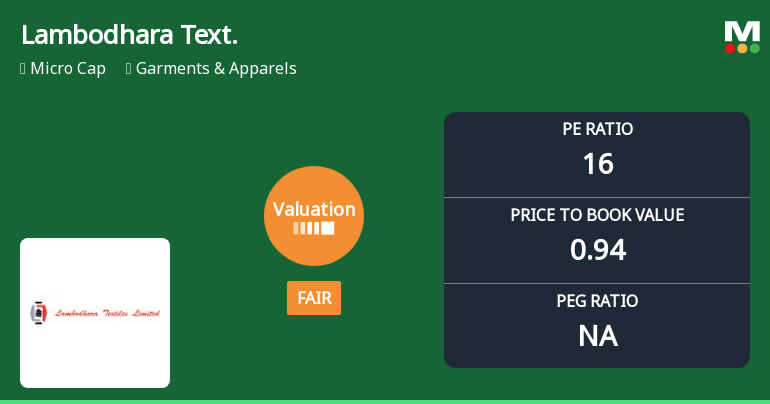

Lambodhara Textiles Ltd Valuation Shifts Signal Changing Market Sentiment

Lambodhara Textiles Ltd, a player in the Garments & Apparels sector, has experienced a notable shift in its valuation parameters, moving from an attractive to a fair valuation grade. This change, coupled with a recent upgrade in its Mojo Grade from Hold to Sell, signals a reassessment of the stock’s price attractiveness amid evolving market dynamics and peer comparisons.

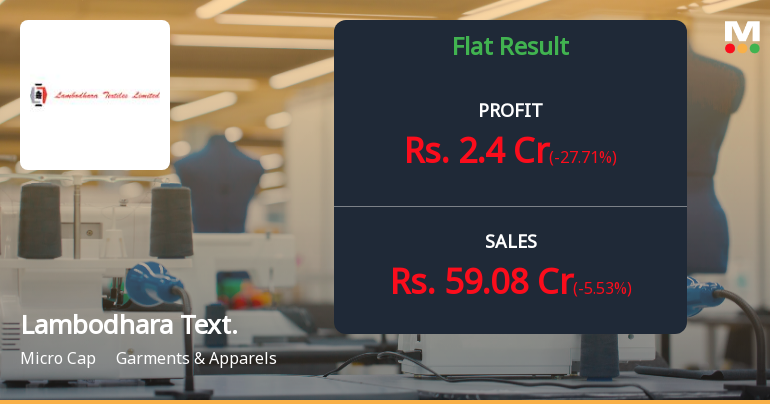

Read full news articleAre Lambodhara Textiles Ltd latest results good or bad?

Lambodhara Textiles Ltd's latest quarterly results for Q3 FY26 reveal significant challenges in profitability despite a modest revenue performance. The company's net sales amounted to ₹59.08 crores, reflecting a sequential decline of 5.53% from the previous quarter. Year-on-year, sales also contracted by 2.86%. More critically, the operating profit margin, excluding other income, fell sharply to 9.39%, down from 14.39% in the prior quarter, indicating substantial operational pressures within the textile manufacturing segment. Net profit for the quarter decreased to ₹2.40 crores, representing a decline of 27.71% compared to the previous quarter. This decline in profitability is primarily attributed to the significant compression in operating margins, which suggests rising input costs or pricing pressures that the company has struggled to manage effectively. The profit after tax (PAT) margin also decreased t...

Read full news article

Lambodhara Textiles Q3 FY26: Profit Slides 28% Despite Stable Revenue as Margins Contract

Lambodhara Textiles Ltd., a Coimbatore-based yarn spinner with a capacity of 37,856 spindles, reported a sharp 27.71% quarter-on-quarter decline in net profit to ₹2.40 crores for Q3 FY26 ended December 2025, despite maintaining relatively stable revenue levels. The micro-cap textile manufacturer, with a market capitalisation of ₹108.00 crores, saw its stock trade at ₹110.40 on January 30, 2026, reflecting a 6.67% single-day gain but remaining 32.15% below its 52-week high of ₹162.70.

Read full news article Announcements

Financial Results For The Quarter And Nine Months Ended 31.12.2025

31-Jan-2026 | Source : BSEBoard of Directors at their meeting held today on 31.01.2026 has approved the unaudited financial results for the quarter and nine months ended 31.12.2025

Board Meeting Outcome for Outcome Of Board Meeting Held On 31St January 2026

31-Jan-2026 | Source : BSEThe Board of Directors of the Company at its meeting held today had considered and approved the unaudited financial results including segment wise results for the quarter and nine months ended 31.12.2025 along with Limited Review Report of Auditors.

Change Of Name Of Mohan & Venkataraman Statutory Auditors Of The Company Upon Conversion Of Firm Into LLP

28-Jan-2026 | Source : BSEPursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulation 2015 the Company hereby informs that the Statutory Auditors of the Company have converted from a partnership firm into a Limited Liability Partnership

Corporate Actions

No Upcoming Board Meetings

Lambodhara Textiles Ltd has declared 10% dividend, ex-date: 15 Sep 25

Lambodhara Textiles Ltd has announced 5:10 stock split, ex-date: 15 Oct 15

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

39.2782

Held by 0 Schemes

Held by 1 FIIs (0.16%)

Strike Right Integrated Services Ltd (37.34%)

None

23.27%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -5.53% vs 5.82% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -27.71% vs 53.70% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 4.43% vs 14.40% in Sep 2024

Growth in half year ended Sep 2025 is 7.47% vs 117.52% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 1.93% vs 16.20% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 19.06% vs 107.86% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 18.99% vs -7.90% in Mar 2024

YoY Growth in year ended Mar 2025 is 47.94% vs -73.35% in Mar 2024