Compare Prima Industries with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -174.42% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 0.19

- The company has been able to generate a Return on Equity (avg) of 4.71% signifying low profitability per unit of shareholders funds

Flat results in Sep 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Edible Oil

INR 19 Cr (Micro Cap)

NA (Loss Making)

30

0.00%

0.14

-0.52%

1.00

Total Returns (Price + Dividend)

Prima Industries for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

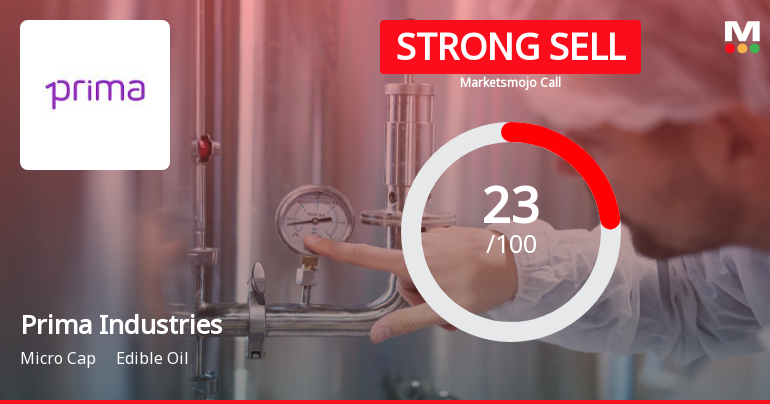

Prima Industries Ltd is Rated Strong Sell

Prima Industries Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 18 Dec 2025, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed below are based on the company’s current position as of 30 December 2025, providing investors with the latest comprehensive view.

Read full news article

Prima Industries: Analytical Perspective Shifts Amid Mixed Financial and Technical Signals

Prima Industries, a player in the edible oil sector, has experienced a revision in its market assessment following a detailed review of its quality, valuation, financial trends, and technical indicators. This article explores the factors influencing the recent changes in the company’s evaluation metrics, providing investors with a comprehensive understanding of its current standing.

Read full news article

Prima Industries Sees Revision in Market Evaluation Amid Mixed Financial Signals

Prima Industries has experienced a revision in its market evaluation, reflecting nuanced shifts across key financial and technical parameters. This adjustment highlights evolving investor perspectives on the microcap edible oil company amid a backdrop of mixed operational performance and market returns.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

22-Jan-2026 | Source : BSEIntimation of Order passed by Honble NCLT for further issue of Unlisted Preference Shares.

Intimation On The Status Of Re-Lodgement Requests For Transfer Of Physical Shares.

13-Jan-2026 | Source : BSEPursuant to Intimation made on the status of re-lodgement requests for transfer of physical shares as per SEBI Circular dated 02nd July 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Jan-2026 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the quarter ended on 31.12.2025.

Corporate Actions

12 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Ayyappa Roller Flour 1203760001197434 (19.8%)

Kusheshwar Jha In30021411627206 (10.19%)

44.8%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -14.42% vs 8.33% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 66.67% vs -140.00% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 8.43% vs -28.94% in Sep 2024

Growth in half year ended Sep 2025 is 55.56% vs -154.55% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -14.95% vs 8.52% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -528.57% vs 333.33% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -4.91% vs 4.89% in Mar 2024

YoY Growth in year ended Mar 2025 is -165.22% vs 2.22% in Mar 2024