Compare Regency Ceramics with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 93.97% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

Risky - Negative EBITDA

Underperformed the market in the last 1 year

Stock DNA

Diversified consumer products

INR 117 Cr (Micro Cap)

84.00

26

0.00%

-1.36

-2.17%

-1.82

Total Returns (Price + Dividend)

Regency Ceramics for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Regency Ceramics Ltd Downgraded to Strong Sell Amid Technical Weakness and Valuation Concerns

Regency Ceramics Ltd has been downgraded from a Sell to a Strong Sell rating as of 29 Jan 2026, reflecting a marked deterioration in its technical indicators alongside persistent fundamental challenges. Despite some positive quarterly financial results, the company’s valuation, financial trend, and technical outlook have all weakened, prompting a reassessment of its investment appeal within the diversified consumer products sector.

Read full news article

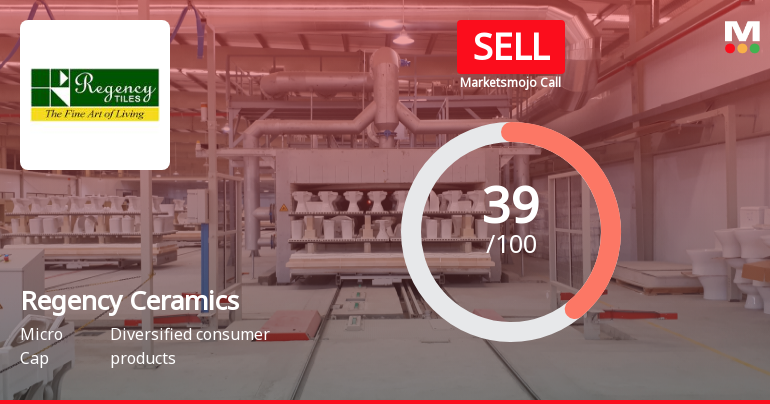

Regency Ceramics Ltd is Rated Sell

Regency Ceramics Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 07 Jan 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Regency Ceramics Downgraded to Strong Sell Amid Technical and Fundamental Concerns

Regency Ceramics Ltd has been downgraded from a Sell to a Strong Sell rating as of 1 January 2026, reflecting a deterioration in its technical outlook and persistent fundamental weaknesses. Despite some positive quarterly financial results, the company faces significant challenges across valuation, financial trends, and technical indicators, prompting a cautious stance from analysts.

Read full news article Announcements

Board Meeting Intimation for To Consider And Approve The Financial Results For The Period Ended December 31 2025

30-Jan-2026 | Source : BSERegency Ceramics Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 12/02/2026 inter alia to consider and approve financial results for the period ended December 31 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Jan-2026 | Source : BSECertificate under Reg.74 (5) of SEBI (DP) regulations 2018

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

30-Dec-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on December 30 2025 for Venktesulu G Doraswamy Naidu G & Narayanamma P

Corporate Actions

12 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (0.01%)

Held by 0 FIIs

Naraiah Naidu Gudaru (27.51%)

Regency Transport Carriers Limited (12.54%)

22.85%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 623.97% vs 404.17% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -64.59% vs -64.74% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 613.36% vs 442.50% in Sep 2024

Growth in half year ended Sep 2025 is -15.06% vs -30.58% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 588.76% vs 0.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -37.26% vs -84.34% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 508.80% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 122.94% vs 37.28% in Mar 2024