Compare Jindal Steel with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 18.51%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.98 times

Poor long term growth as Operating profit has grown by an annual rate -5.80% of over the last 5 years

The company has declared negative results for the last 2 consecutive quarters

With ROCE of 10.4, it has a Fair valuation with a 2 Enterprise value to Capital Employed

High Institutional Holdings at 28.11%

Market Beating performance in long term as well as near term

Stock DNA

Ferrous Metals

INR 117,718 Cr (Large Cap)

35.00

28

0.18%

0.29

8.01%

2.31

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Aug-22-2025

Risk Adjusted Returns v/s

Returns Beta

News

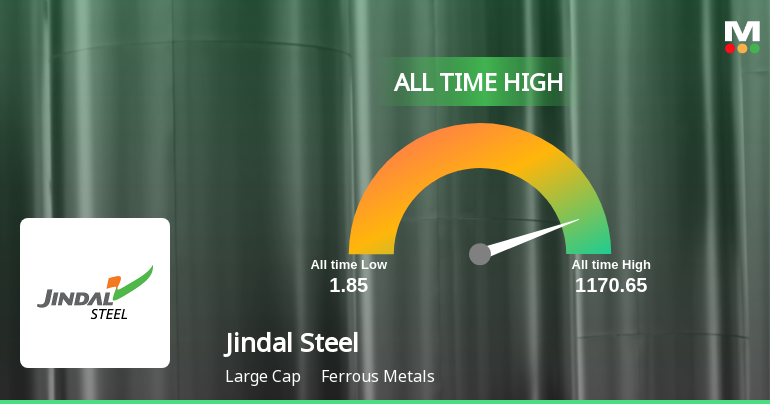

Jindal Steel Ltd. Hits New 52-Week High at Rs.1170.65

Jindal Steel Ltd. has reached a significant milestone by hitting a new 52-week high of Rs.1170.65, marking a notable surge in the ferrous metals sector. This achievement reflects the stock’s strong momentum amid a mixed market environment on 3 February 2026.

Read full news article

Jindal Steel Ltd. Stock Hits Record High of Rs.1170.65 Amid Strong Market Momentum

Jindal Steel Ltd. has reached a new all-time high of Rs.1170.65, underscoring a remarkable performance trajectory in the ferrous metals sector. This milestone reflects sustained gains and robust market positioning, with the stock outperforming many benchmarks over multiple timeframes.

Read full news article

Jindal Steel Ltd. Technical Momentum Shifts Amid Mixed Market Signals

Jindal Steel Ltd. has experienced a nuanced shift in its technical momentum, moving from a bullish to a mildly bullish stance as of early February 2026. Despite a recent dip in price, key indicators such as the MACD and moving averages continue to signal underlying strength, while other metrics like the KST and Dow Theory suggest caution. This article analyses the evolving technical landscape of Jindal Steel, placing it in the context of broader market trends and its own historical performance.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

31-Jan-2026 | Source : BSEDisclosure under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 - Newspaper Advertisement

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

31-Jan-2026 | Source : BSEAUDIO RECORDING OF EARNINGS CALL HELD ON JANUARY 31 2026

Results - Financial Results For December 31 2025

30-Jan-2026 | Source : BSEResults- Financial Results for December 31 2025

Corporate Actions

No Upcoming Board Meetings

Jindal Steel Ltd. has declared 200% dividend, ex-date: 22 Aug 25

Jindal Steel Ltd. has announced 1:5 stock split, ex-date: 21 Jan 08

Jindal Steel Ltd. has announced 5:1 bonus issue, ex-date: 14 Sep 09

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

10.8699

Held by 41 Schemes (14.42%)

Held by 464 FIIs (9.02%)

Opj Trading Private Limited (18.47%)

Kotak Flexicap Fund (3.56%)

5.86%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 11.47% vs -4.95% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -70.16% vs -57.28% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -3.43% vs -0.03% in Sep 2024

Growth in half year ended Sep 2025 is -3.13% vs -28.42% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 1.16% vs 0.11% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -26.30% vs -37.01% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -0.52% vs -5.09% in Mar 2024

YoY Growth in year ended Mar 2025 is -52.65% vs 87.10% in Mar 2024