Compare Jindal Drilling with Similar Stocks

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Aug-14-2025

Risk Adjusted Returns v/s

Returns Beta

News

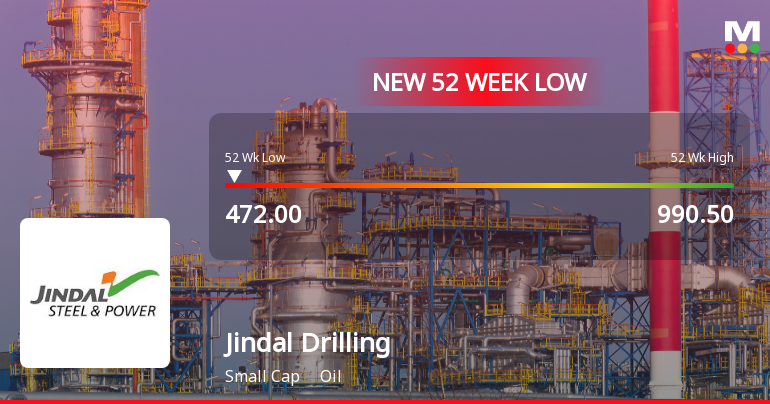

Jindal Drilling & Industries Ltd Falls to 52-Week Low of Rs.480.05

Jindal Drilling & Industries Ltd has touched a new 52-week low of Rs.480.05 today, marking a significant decline amid broader market fluctuations and company-specific performance factors. The stock’s fall reflects a continuation of a downward trend that has seen it underperform its sector and the broader market over the past year.

Read full news article

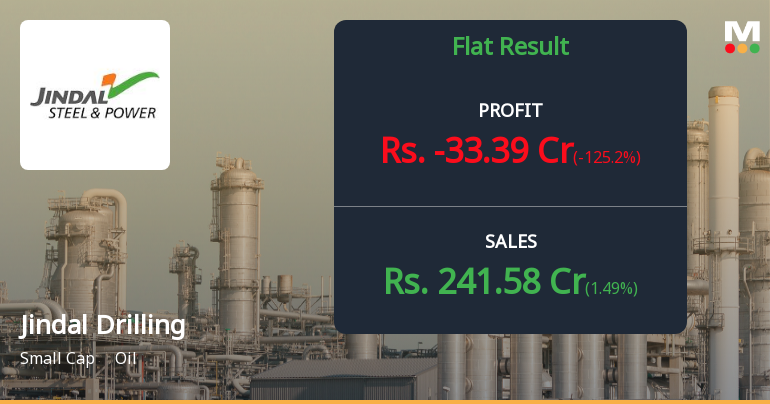

Jindal Drilling Q3 FY26: Exceptional Profit Anomaly Masks Operational Strength

Jindal Drilling & Industries Ltd., a small-cap oil drilling services company with a market capitalisation of ₹1,522 crores, reported a consolidated net loss of ₹33.39 crores for Q3 FY26, a stark reversal from the ₹132.52 crores profit recorded in Q2 FY26. The dramatic 125.20% quarter-on-quarter decline was driven by an exceptional ₹80.52 crores negative adjustment in other income, whilst underlying operational performance remained resilient. The stock plunged 9.62% following the announcement, trading at ₹477.00, as investors reacted to the headline loss figure.

Read full news article

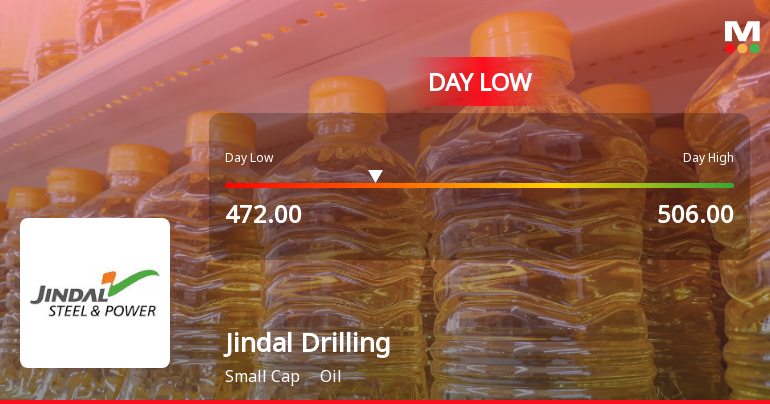

Jindal Drilling & Industries Ltd Hits Intraday Low Amid Price Pressure

Shares of Jindal Drilling & Industries Ltd declined sharply on 29 Jan 2026, hitting an intraday low of Rs 486 as the stock faced significant price pressure, underperforming its sector and broader market indices amid a negative market sentiment.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

27-Jan-2026 | Source : BSEEarnings Call For Q3 FY 2025-26.

Board Meeting Intimation for Approval Of Unaudited Financial Results For The Quarter And Nine Months Ended December 31 2025

15-Jan-2026 | Source : BSEJindal Drilling & Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 28/01/2026 inter alia to consider and approve the unaudited financial results for the quarter and nine months ended December 31 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Jan-2026 | Source : BSECertificate Under Regulation 74(5) of SEBI (Depositories and Participants) Regulation 2018 for the quarter ended on December 31 2025

Corporate Actions

No Upcoming Board Meetings

Jindal Drilling & Industries Ltd has declared 20% dividend, ex-date: 14 Aug 25

Jindal Drilling & Industries Ltd has announced 5:10 stock split, ex-date: 06 Nov 08

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 30 FIIs (0.85%)

Jindal Global Finance And Investment Ltd (17.4%)

Babul Holdings Pvt. Ltd (3.45%)

19.71%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 1.49% vs -6.32% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -125.20% vs 100.45% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 43.27% vs 45.53% in Sep 2024

Growth in half year ended Sep 2025 is 153.49% vs 129.09% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 25.86% vs 39.10% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 14.50% vs 118.17% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 34.19% vs 20.47% in Mar 2024

YoY Growth in year ended Mar 2025 is 322.09% vs -47.21% in Mar 2024