Compare Saffron Industri with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -9.38% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

Risky - Negative Book Value

Stock DNA

Paper, Forest & Jute Products

INR 22 Cr (Micro Cap)

6.00

16

0.00%

-0.20

-36.28%

-2.17

Total Returns (Price + Dividend)

Saffron Industri for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

When is the next results date for Saffron Industries Ltd?

The next results date for Saffron Industries Ltd is scheduled for 11 February 2026....

Read full news article

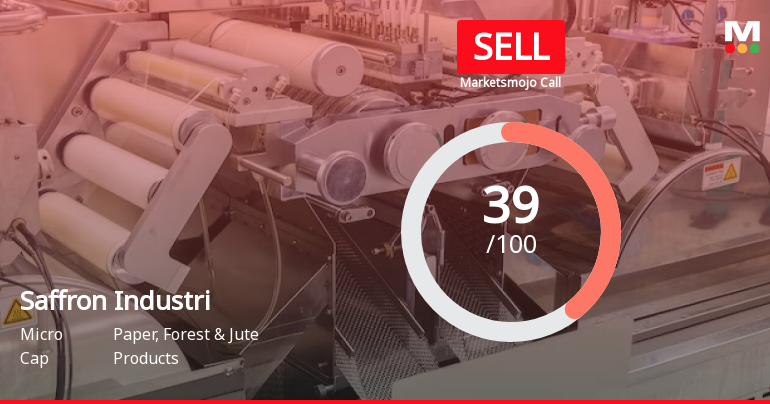

Saffron Industries Ltd is Rated Sell

Saffron Industries Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 09 June 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 26 December 2025, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Saffron Industri Sees Revision in Market Evaluation Amid Mixed Financial Signals

Saffron Industri, a microcap player in the Paper, Forest & Jute Products sector, has experienced a revision in its market evaluation metrics, reflecting nuanced shifts across its quality, valuation, financial trend, and technical outlook. This adjustment comes amid a backdrop of volatile stock returns and contrasting fundamental indicators.

Read full news article Announcements

Board Meeting Intimation for Consideration Of Unaudited Financial Results For The Quarter Ended On 31St December 2025.

05-Feb-2026 | Source : BSESaffron Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 11/02/2026 inter alia to consider and approve Notice is hereby given pursuant to Regulation 29(1)(a) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 that a meeting of the Board of Directors of the Company is scheduled to be held on Wednesday11th February 2026 inter alia to consider discuss and approve Unaudited Financial Results for the quarter ended on 31st December 2025. Trading Window for dealing in securities of the Company by its Designated Persons and their Immediate Relative(s) has been closed from 10th January 2026 and will remain closed till 48 hours after the time when the Unaudited Financial Results of the Company as aforesaid are communicated to the Stock Exchange/s and made available to the general public. You are requested to take the above information on record.

Intimation Of Notice Of Extra- Ordinary General Meeting Of The Saffron Industries Limited.

16-Jan-2026 | Source : BSEThis is to inform you that the Extra- Ordinary General Meeting (EGM) of the Company will be held on Thursday February 12 2026 at 11:00 AM at the Registered Office of the Company. The Copy of the Notice of EGM is attached. The Company is providing to all its members the facility to cast their vote by electronic means on all the resolutions as set out in the Notice. The remote e-Voting period will commence from Monday February 9 2026 at 9:00 AM and ends on wednesday February 11 2026 at 5:00PM. You are requested to Kindly take the above information on record.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Jan-2026 | Source : BSEPlease find enclosed herewith a Certificate issued under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 by Adroit Corporate Services Private Limited the Registrar and Share Transfer Agent of the Company for the period from 01st October 2025 to 31st December 2025. You are requested to take above information on records..

Corporate Actions

11 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.11%)

Held by 0 FIIs

Nimish Vinod Maheshwari (18.34%)

Raju Bhandari (4.88%)

36.24%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -73.87% vs -8.28% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 366.67% vs -103.09% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 750.00% vs -84.51% in Sep 2024

Growth in half year ended Sep 2025 is 128.30% vs 57.60% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -56.25% vs -49.51% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 93.59% vs -116.67% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -60.99% vs -4.82% in Mar 2024

YoY Growth in year ended Mar 2025 is 248.68% vs -26.00% in Mar 2024