Compare Parker Agrochem with Similar Stocks

Stock DNA

Trading & Distributors

INR 8 Cr (Micro Cap)

14.00

15

0.00%

0.08

14.85%

2.03

Total Returns (Price + Dividend)

Parker Agrochem for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

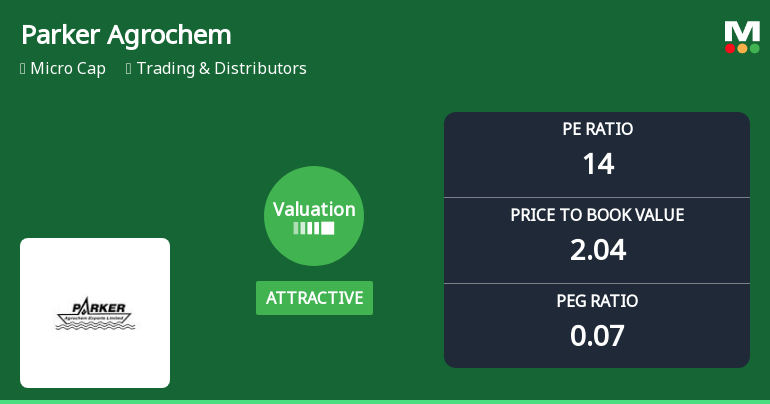

Parker Agrochem Exports Ltd: Valuation Shift Enhances Price Attractiveness Amid Mixed Returns

Parker Agrochem Exports Ltd has witnessed a notable shift in its valuation parameters, moving from a very attractive to an attractive rating, driven primarily by changes in its price-to-earnings and price-to-book value ratios. Despite mixed short-term returns, the company’s valuation now presents a more compelling case relative to its historical averages and peer group, though caution remains warranted given its current MarketsMOJO Sell grade and sector dynamics.

Read full news article

Parker Agrochem Exports Ltd Upgraded to Hold on Improved Technicals and Financials

Parker Agrochem Exports Ltd has seen its investment rating upgraded from Sell to Hold, driven primarily by a marked improvement in technical indicators and robust financial performance. The company’s enhanced technical trend, coupled with strong quarterly results and rising promoter confidence, has prompted analysts to revise their outlook, signalling a more favourable stance on this micro-cap player in the Trading & Distributors sector.

Read full news article

Parker Agrochem Exports Ltd is Rated Sell

Parker Agrochem Exports Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 23 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 24 December 2025, providing investors with the most up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article Announcements

Board Meeting Intimation for Taking On Record Unaudited Financial Results For The Quarter Ended On 31St December 2025

30-Jan-2026 | Source : BSEParker Agrochem Exports Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve Unaudited Financial Results for the quarter ended on 31st December 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Jan-2026 | Source : BSECertificate under Regulation 74(50 of SEBI (DP) Regulations for the quarter ended on 31-12-2025

Closure of Trading Window

31-Dec-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

13 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Jagdishbhai R Acharya (54.23%)

Kunvarji Finstock Private Limited (2.73%)

33.97%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 52.53% vs -91.29% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 1,275.00% vs -126.67% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 76.06% vs -55.06% in Sep 2024

Growth in half year ended Sep 2025 is 202.44% vs -131.30% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 1,050.94% vs 62.24% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -125.00% vs 404.35% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 1,113.55% vs 26.68% in Mar 2024

YoY Growth in year ended Mar 2025 is -118.69% vs 64.62% in Mar 2024