Compare Checkpoint Trend with Similar Stocks

Dashboard

High Management Efficiency with a high ROE of 17.29%

Company has a low Debt to Equity ratio (avg) at 0.05 times

Healthy long term growth as Net Sales has grown by an annual rate of 211.82%

The company has declared Positive results for the last 4 consecutive quarters

With ROE of 104.4, it has a Attractive valuation with a 31.1 Price to Book Value

Majority shareholders : Non Institution

Market Beating Performance

Stock DNA

Pharmaceuticals & Biotechnology

INR 63 Cr (Micro Cap)

30.00

32

0.00%

-0.07

104.42%

31.77

Total Returns (Price + Dividend)

Checkpoint Trend for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Checkpoint Trends Ltd is Rated Hold

Checkpoint Trends Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 04 September 2025. However, the analysis and financial metrics presented here reflect the company’s current position as of 30 January 2026, providing investors with an up-to-date view of the stock’s fundamentals, returns, and technical outlook.

Read full news articleAre Checkpoint Trends Ltd latest results good or bad?

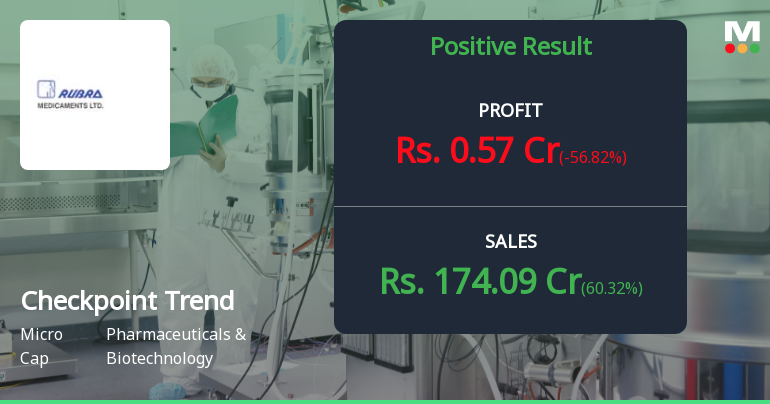

Checkpoint Trends Ltd's latest financial results for Q3 FY26 present a complex picture characterized by significant revenue growth alongside notable profitability challenges. The company's net sales reached ₹174.09 crores, reflecting a sequential growth of 60.32% from the previous quarter, which is a substantial increase compared to the same period last year. This growth trajectory underscores the company's successful pivot from pharmaceutical manufacturing to trading operations, marking a remarkable year-on-year revenue increase of 173,990%. However, this revenue surge has not translated into improved profitability. The net profit for the quarter was ₹0.57 crores, representing a decline of 56.82% from the prior quarter's net profit of ₹1.32 crores. Additionally, the operating margin has contracted to 0.44%, down from 1.65% in Q2 FY26, indicating that the company is facing challenges in converting its sale...

Read full news article

Checkpoint Trends Q3 FY26: Explosive Revenue Surge Masks Wafer-Thin Margins in Trading Pivot

Checkpoint Trends Limited (formerly Rubra Medicaments Ltd.), a micro-cap pharmaceutical company with a market capitalisation of ₹66.00 crores, reported a net profit of ₹0.57 crores for Q3 FY26, marking a decline of 56.82% quarter-on-quarter but a turnaround from losses recorded in the corresponding quarter last year. The company's stock, trading at ₹123.95, has surged 1089.54% over the past year, reflecting extraordinary investor enthusiasm despite fundamental concerns about profitability and business model sustainability.

Read full news article Announcements

Shareholder Meeting / Postal Ballot-Scrutinizers Report

02-Feb-2026 | Source : BSEScrutinizer Report

Shareholder Meeting / Postal Ballot-Scrutinizers Report

02-Feb-2026 | Source : BSEOutcome of EGM

Announcement under Regulation 30 (LODR)-Newspaper Publication

30-Jan-2026 | Source : BSENewspaper publication

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 3 FIIs (10.71%)

None

Religare Finvest Ltd (5.89%)

75.24%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 60.32% vs 827.33% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -56.82% vs 1,366.67% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 80,106.67% vs -69.39% in Sep 2024

Growth in half year ended Sep 2025 is 7,150.00% vs -110.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 1,17,660.00% vs -62.12% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 5,050.00% vs -115.38% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -55.75% vs -2.59% in Mar 2024

YoY Growth in year ended Mar 2025 is 0.00% vs 137.50% in Mar 2024