Compare Comfort Intech with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Equity (ROE) of 6.76%

- Poor long term growth as Operating profit has grown by an annual rate of 2.88%

Flat results in Dec 25

With ROE of 0.7, it has a Very Expensive valuation with a 1.1 Price to Book Value

26.48% of Promoter Shares are Pledged

Underperformed the market in the last 1 year

Stock DNA

Beverages

INR 202 Cr (Micro Cap)

NA (Loss Making)

22

1.14%

0.12

0.68%

1.02

Total Returns (Price + Dividend)

Latest dividend: 0.07 per share ex-dividend date: Sep-18-2025

Risk Adjusted Returns v/s

Returns Beta

News

Comfort Intech Ltd Stock Falls to 52-Week Low of Rs.5.66

Comfort Intech Ltd, a player in the beverages sector, has touched a fresh 52-week low of Rs.5.66 today, marking a significant decline in its stock price amid subdued financial performance and valuation concerns.

Read full news article

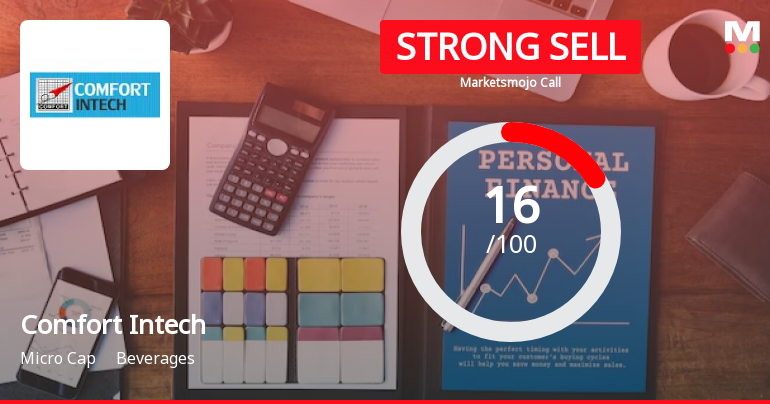

Comfort Intech Ltd is Rated Strong Sell

Comfort Intech Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 20 January 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 28 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news articleAre Comfort Intech Ltd latest results good or bad?

Comfort Intech Ltd's latest financial results reveal a complex picture of operational challenges and volatility. In Q2 FY26, the company reported consolidated net sales of ₹38.17 crores, reflecting a significant quarter-on-quarter recovery of 88.03% from ₹20.30 crores in Q1 FY26. However, this figure still represents a year-on-year decline of 13.39% compared to ₹44.07 crores in Q2 FY25, indicating persistent pressure on revenue generation. The consolidated net profit for the same quarter was a loss of ₹2.12 crores, marking a substantial deterioration from a profit of ₹1.98 crores in the previous quarter. This loss underscores deeper issues within the company, particularly as it reflects a negative swing in other income, which turned from a positive ₹1.42 crores in Q1 FY26 to a negative ₹2.21 crores in Q2 FY26. This volatility in non-operating income raises concerns about the sustainability of earnings and ...

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

20-Jan-2026 | Source : BSENewspaper Publication regarding Postal Ballot and E-Voting Information.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

19-Jan-2026 | Source : BSEPostal Ballot Notice dated January 15 2026.

Announcement under Regulation 30 (LODR)-Newspaper Publication

16-Jan-2026 | Source : BSENewspaper Publication for the Financial Results for the Quarter and Nine Months ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

Comfort Intech Ltd has declared 7% dividend, ex-date: 18 Sep 25

Comfort Intech Ltd has announced 1:10 stock split, ex-date: 13 Apr 23

No Bonus history available

Comfort Intech Ltd has announced 1:1 rights issue, ex-date: 02 Jun 10

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

26.4751

Held by 0 Schemes

Held by 0 FIIs

Luharuka Exports Pvt Ltd (26.44%)

None

39.38%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 60.78% vs 88.03% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 80.66% vs -141.57% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -29.54% vs 66.19% in Sep 2024

Growth in half year ended Sep 2025 is -77.00% vs 73.80% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -7.20% vs 34.63% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -84.99% vs 20.89% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -0.76% vs 9.58% in Mar 2024

YoY Growth in year ended Mar 2025 is -34.38% vs 145.03% in Mar 2024