Compare Telogica with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 5.66%

- Poor long term growth as Operating profit has grown by an annual rate 16.15% of over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of -1.00 times

Flat results in Sep 25

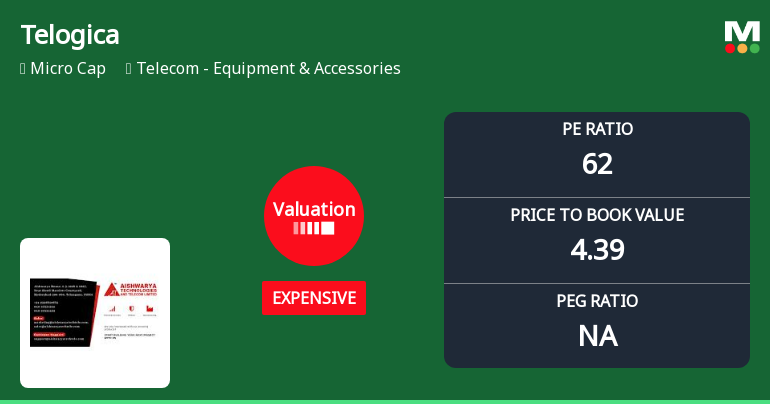

With ROCE of 7.1, it has a Expensive valuation with a 4 Enterprise value to Capital Employed

Below par performance in long term as well as near term

Stock DNA

Telecom - Equipment & Accessories

INR 63 Cr (Micro Cap)

62.00

16

0.00%

0.13

7.13%

4.39

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Sep-16-2011

Risk Adjusted Returns v/s

Returns Beta

News

Telogica Ltd is Rated Strong Sell

Telogica Ltd is rated 'Strong Sell' by MarketsMOJO, a rating that was last updated on 18 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 03 February 2026, providing investors with an up-to-date view of the company's performance and outlook.

Read full news article

Telogica Ltd Valuation Shifts Signal Elevated Price Risk Amid Sector Challenges

Telogica Ltd, a key player in the Telecom - Equipment & Accessories sector, has seen its valuation metrics shift notably towards an expensive classification, despite a mixed performance track record and a recent upgrade in its Mojo Grade to Strong Sell. This article analyses the evolving price attractiveness of Telogica, comparing its current valuation multiples against historical averages and peer benchmarks, while contextualising its market returns and operational metrics.

Read full news article

Telogica Ltd Forms Death Cross, Signalling Potential Bearish Trend

Telogica Ltd, a micro-cap player in the Telecom - Equipment & Accessories sector, has recently formed a Death Cross, a significant technical indicator where the 50-day moving average crosses below the 200-day moving average. This development signals a potential deterioration in the stock’s trend and raises concerns about sustained bearish momentum in the near to medium term.

Read full news article Announcements

Board Meeting Intimation for Consideration And Approval Of Un-Audited Financial Results Of The Company For The Quarter Ended 31St December 2025.

30-Jan-2026 | Source : BSETelogica Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 05/02/2026 inter alia to consider and approve Un-Audited Financial Results Of The Company For The Quarter Ended 31st December 2025.

Disclosure Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI (LODR) 2015)-Trading Approval From BSE Limited

30-Jan-2026 | Source : BSEWe would like to inform that the Company has received Trading Approval dated January 30 2026 from BSE Limited for 31550000 equity shares of Rs. 5/- each allotted to promoter and non-promoters pursuant to conversion of warrants.

Announcement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

12-Jan-2026 | Source : BSEPursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform you that Mr. Khush Mohammed has resigned from the post of Company Secretary and Compliance Officer.

Corporate Actions

05 Feb 2026

Telogica Ltd has declared 2% dividend, ex-date: 16 Sep 11

Telogica Ltd has announced 5:10 stock split, ex-date: 24 Feb 10

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Srinivasa Rao Mandava (17.51%)

Logiclinx Corporation (15.31%)

36.16%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 10.73% vs 23.94% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -54.05% vs 42.31% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 8.64% vs 72.46% in Sep 2024

Growth in half year ended Sep 2025 is -70.09% vs 3,466.67% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -11.95% vs 297.01% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -63.06% vs 974.19% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 7.95% vs 302.25% in Mar 2024

YoY Growth in year ended Mar 2025 is 102.38% vs 177.78% in Mar 2024