Compare Ramky Infra with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a 12.67% CAGR growth in Net Sales over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.50

The company has declared Negative results for the last 3 consecutive quarters

25.7% of Promoter Shares are Pledged

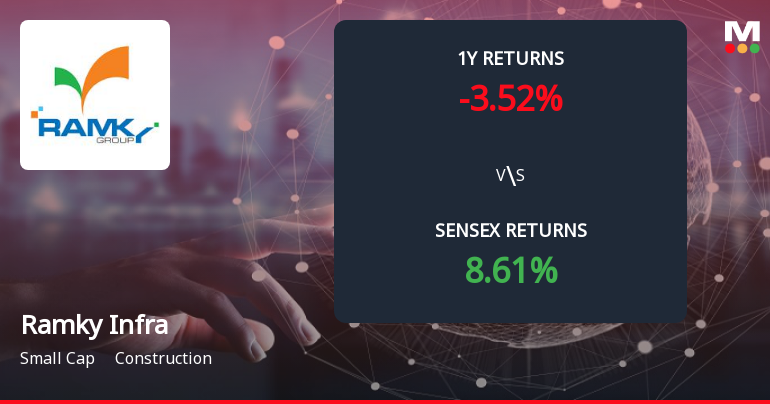

Underperformed the market in the last 1 year

Total Returns (Price + Dividend)

Latest dividend: 4.5 per share ex-dividend date: Aug-04-2011

Risk Adjusted Returns v/s

Returns Beta

News

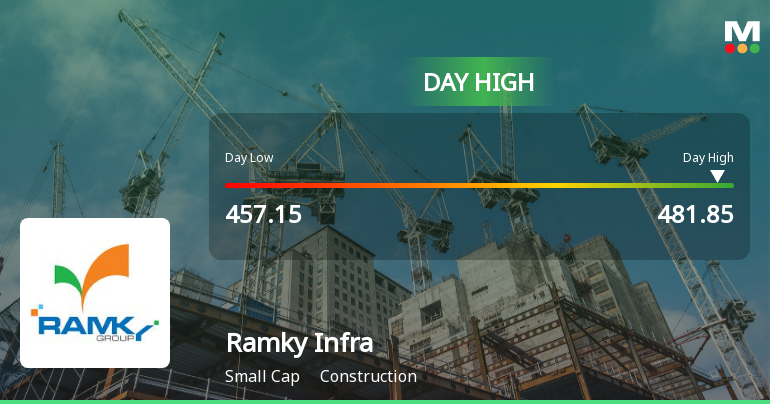

Ramky Infrastructure Ltd Hits Intraday High with 7.34% Surge on 3 Feb 2026

Ramky Infrastructure Ltd recorded a robust intraday performance on 3 Feb 2026, surging 7.34% to touch a day’s high of Rs 480, significantly outperforming the broader Sensex and its sector peers amid active trading and positive market momentum.

Read full news article

Ramky Infrastructure Ltd Forms Death Cross, Signalling Bearish Trend Ahead

Ramky Infrastructure Ltd has recently formed a Death Cross, a significant technical indicator where the 50-day moving average crosses below the 200-day moving average. This development signals a potential shift towards a bearish trend, reflecting deteriorating momentum and raising concerns about the stock’s near- to medium-term outlook.

Read full news article

Ramky Infrastructure Ltd is Rated Strong Sell

Ramky Infrastructure Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 01 Jan 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 24 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

27-Jan-2026 | Source : BSECOMPANY HAS FILED COMPLIANCE CERTIFICATE UNDER REGULATION 75 OF DEPOSITORY PARTICIPANTS REGULATIONS

Company Has Issued Notice Of The Postal Ballot

07-Jan-2026 | Source : BSEThe company has sent Notice of the postal ballot to its shareholders for approval of related party transactions

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

07-Jan-2026 | Source : BSEThe company has filed Postal Ballot Notice for approval of related party transaction

Corporate Actions

No Upcoming Board Meetings

Ramky Infrastructure Ltd has declared 45% dividend, ex-date: 04 Aug 11

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

25.6956

Held by 1 Schemes (0.0%)

Held by 44 FIIs (1.23%)

Sharan Alla (31.95%)

Aadi Financial Advisors Llp (2.41%)

19.09%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -10.58% vs -9.35% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -3.82% vs -30.57% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -22.40% vs -3.69% in Sep 2024

Growth in half year ended Sep 2025 is 2.63% vs -31.87% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -1.50% vs 39.92% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -19.28% vs 294.52% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -5.37% vs 26.71% in Mar 2024

YoY Growth in year ended Mar 2025 is -35.83% vs -73.01% in Mar 2024