Compare Virat Crane Inds with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- The company has been able to generate a Return on Equity (avg) of 9.83% signifying low profitability per unit of shareholders funds

Flat results in Dec 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

FMCG

INR 62 Cr (Micro Cap)

NA (Loss Making)

48

0.00%

0.18

-11.36%

0.96

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Sep-19-2018

Risk Adjusted Returns v/s

Returns Beta

News

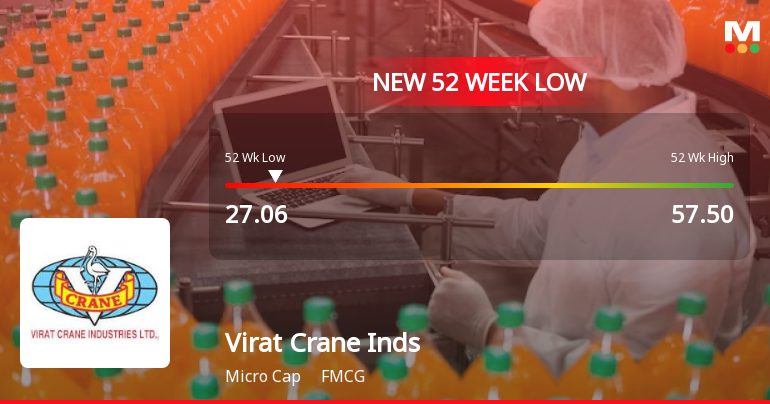

Virat Crane Industries Ltd Falls to 52-Week Low of Rs.27.06

Virat Crane Industries Ltd, a player in the FMCG sector, touched a new 52-week low of Rs.27.06 today, marking a significant decline in its stock price amid a broader market downturn and sectoral pressures.

Read full news article

Virat Crane Industries Ltd is Rated Strong Sell

Virat Crane Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 07 August 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 04 March 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

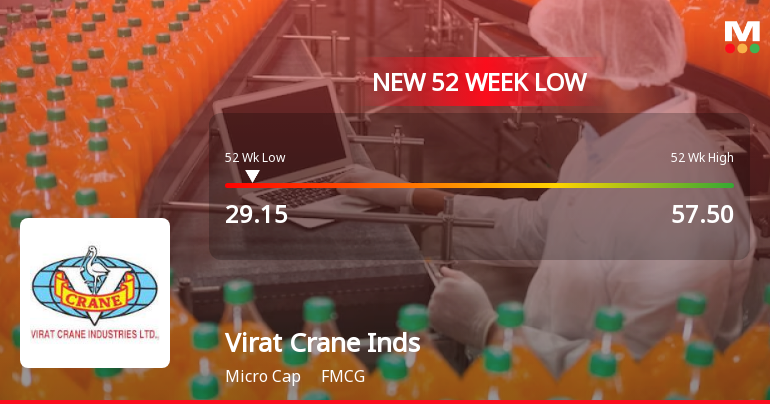

Virat Crane Industries Ltd Falls to 52-Week Low Amidst Continued Downtrend

Shares of Virat Crane Industries Ltd, a player in the FMCG sector, declined sharply to a fresh 52-week low of Rs.29.15 on 2 Mar 2026, marking a significant downturn in the stock’s performance amid broader sectoral and company-specific pressures.

Read full news article Announcements

Submission Of Un-Audited Financial Results For The 3Rd Quarter Of The Financial Year Ended On 31-12-2025 For The F.Y 2025-26

14-Feb-2026 | Source : BSESubmission of the Un-Audited Financial results for the 3rd quarter period ended on 31-12-2025 for the F.Y2025-26

Board Meeting Outcome for Outcome Of The Board Meeting & Submission Of Un-Audited Financial Results For The 3Rd Quarter Of The Financial Year Ended On 31-12-2025 For The F.Y 2025-26

14-Feb-2026 | Source : BSEOutcome of the Board Meeting & Submission of un-Audited Financial Results for the 3rd quarter of the financial year ended on 31-12-2025 for the F.Y 2025-26.

Closure of Trading Window

04-Feb-2026 | Source : BSEIntimation of the Board meeting date for the purpose of the end of the closure of the trading window periodin continuation to the earlier submission of the closure of the trading window period

Corporate Actions

No Upcoming Board Meetings

Virat Crane Industries Ltd has declared 5% dividend, ex-date: 19 Sep 18

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Grandhi Venkata Satya Lakshmi Kantha Rao (46.26%)

Dheeraj Kumar Lohia (2.33%)

18.12%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 26.70% vs -5.75% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 54.89% vs -240.74% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 30.95% vs -3.10% in Sep 2024

Growth in half year ended Sep 2025 is -211.89% vs 32.41% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 28.29% vs 0.60% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -220.97% vs -2.20% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 3.51% vs 9.23% in Mar 2024

YoY Growth in year ended Mar 2025 is -53.85% vs 348.04% in Mar 2024