Compare Nath Bio-Genes with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -0.21% CAGR growth in Operating Profits over the last 5 years

- The company has been able to generate a Return on Equity (avg) of 6.31% signifying low profitability per unit of shareholders funds

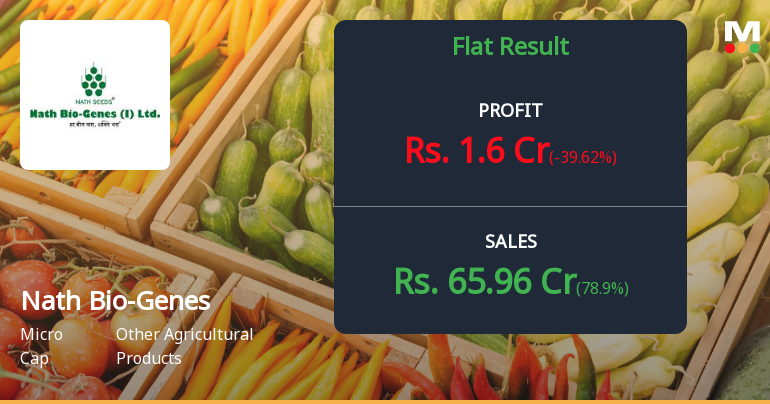

Flat results in Sep 25

Falling Participation by Institutional Investors

Below par performance in long term as well as near term

Stock DNA

Other Agricultural Products

INR 271 Cr (Micro Cap)

7.00

13

1.40%

0.23

6.23%

0.40

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Aug-14-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Nath Bio-Genes (India) Ltd latest results good or bad?

Nath Bio-Genes (India) Ltd's latest financial results reveal a complex picture of operational performance marked by significant volatility. In the quarter ended September 2025, the company reported net sales of ₹43.85 crores, which reflects a notable year-on-year growth of 36.22% compared to ₹32.19 crores in the same quarter last year. However, this figure represents a substantial decline of 84.54% from the preceding quarter's sales of ₹283.70 crores, highlighting the seasonality inherent in its agricultural products business. The net profit for the same quarter was ₹2.75 crores, showing a remarkable year-on-year increase of 147.75% from ₹1.11 crores in Q2 FY25. Conversely, it experienced a sharp decline of 92.62% compared to the previous quarter's profit of ₹37.28 crores. This extreme fluctuation underscores the challenges in assessing the company's performance on a quarter-to-quarter basis. The operatin...

Read full news article

Nath Bio-Genes Q3 FY26: Seasonal Surge Masks Profitability Concerns

Nath Bio-Genes (India) Ltd., a micro-cap agricultural products company with a market capitalisation of ₹271.00 crores, reported a consolidated net profit of ₹1.60 crores for Q3 FY26 (October-December 2025), representing a sharp 66.80% decline quarter-on-quarter and a 39.62% fall year-on-year. Despite a robust 78.90% YoY revenue increase to ₹65.96 crores driven by seasonal demand, the company's profitability deteriorated significantly as operating margins compressed and interest costs surged to their highest quarterly levels.

Read full news article

Nath Bio-Genes (India) Ltd is Rated Strong Sell

Nath Bio-Genes (India) Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 07 Jan 2026, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 27 January 2026, providing investors with the latest perspective on the company’s performance and prospects.

Read full news article Announcements

Board Meeting Intimation for Approval Of Financial Results As On 31St December 2025.

24-Jan-2026 | Source : BSENath Bio-Genes (India) Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 31/01/2026 inter alia to consider and approve Financial Results as on 31st December 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

20-Jan-2026 | Source : BSECompliance Certificate under Reg 74

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

13-Jan-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Tapovan Paper and Board Mills Ltd & Others

Corporate Actions

(31 Jan 2026)

Nath Bio-Genes (India) Ltd has declared 20% dividend, ex-date: 14 Aug 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

13.7797

Held by 8 Schemes (0.01%)

Held by 4 FIIs (0.31%)

Ashu Farms Llp (13.68%)

Mayo Farms Llp (5.72%)

34.22%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 78.90% vs 16.16% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -39.62% vs -30.81% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 18.65% vs 7.07% in Sep 2024

Growth in half year ended Sep 2025 is 16.13% vs -0.69% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 25.75% vs 8.06% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 12.15% vs -3.68% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 9.71% vs 10.37% in Mar 2024

YoY Growth in year ended Mar 2025 is -2.57% vs 13.10% in Mar 2024