Compare IFB Industries with Similar Stocks

Stock DNA

Electronics & Appliances

INR 4,502 Cr (Small Cap)

34.00

41

0.00%

-0.18

13.74%

4.81

Total Returns (Price + Dividend)

IFB Industries for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

IFB Industries Ltd Downgraded to Sell Amid Mixed Financial and Valuation Signals

IFB Industries Ltd has been downgraded from a Hold to a Sell rating by MarketsMOJO as of 27 Jan 2026, reflecting a complex interplay of financial performance, valuation concerns, and technical indicators. Despite some positive quarterly results and healthy operating profit growth, the stock’s underperformance relative to benchmarks and a deteriorating mojo score have prompted a cautious stance from analysts.

Read full news article

IFB Industries Ltd is Rated Hold by MarketsMOJO

IFB Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 20 Nov 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 27 January 2026, providing investors with an up-to-date perspective on the company's performance and outlook.

Read full news article

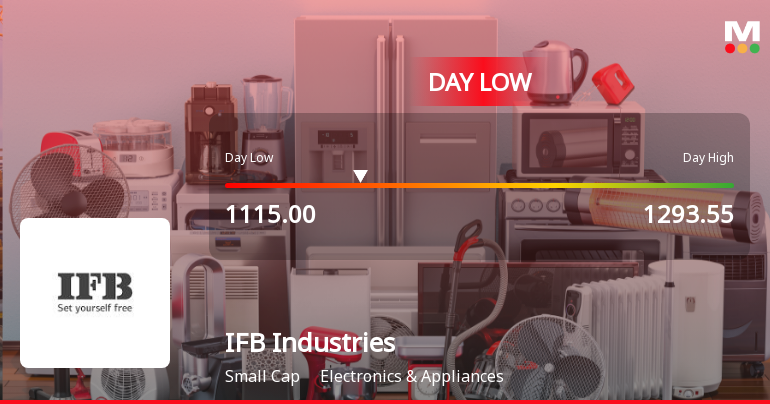

IFB Industries Ltd Hits Intraday Low Amid Price Pressure on 27 Jan 2026

IFB Industries Ltd experienced a sharp decline today, touching an intraday low of Rs 1,150.6, reflecting a steep fall of 14.91% from its previous close. The stock underperformed its sector and broader market indices amid heightened volatility and sustained selling pressure.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

25-Jan-2026 | Source : BSEPursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 please find enclosed copies of the newspaper clippings of the advertisement published on the subject matter on 25th January 2026 in following newspapers: - Financial Express- English. Aajkal - Bengali.

Disclosure Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

24-Jan-2026 | Source : BSEPursuant to regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we hereby inform you that M/s. Shome & Banerjee Cost Accountants (Firm Registration No. 000001) have vide their letter dated 23rd January 2025 (copy attached) have tendered their resignation on account of certain unavoidable circumstances at their end to continue as Cost Auditors of the Company for the financial year ending 31st March 2026.

Announcement under Regulation 30 (LODR)-Change in Management

24-Jan-2026 | Source : BSEWe hereby inform that the Board of Directors of IFB Industries Limited (the Company) at its Meeting held on 24th January 2026 inter-alia transacted the following business: 1. Considered and approved the re-appointment of Ms. Sreedevi Pillai (DIN: 08944944) 2. Mr. Saurav Adhikari (DIN: 08402010)3. Mr. Subir Chakraborty (DIN: 00130864) 4. appointment of Mr. Ashok Bhandari (DIN: 00012210) Director of the Company 5. Appointment of Mani & Co. as cost Auditor.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 16 Schemes (5.64%)

Held by 38 FIIs (0.97%)

Ifb Automotive Private Limited (46.54%)

Dsp Small Cap Fund (4.66%)

12.73%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 11.27% vs 9.36% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -23.00% vs 78.17% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 8.85% vs 13.80% in Sep 2024

Growth in half year ended Sep 2025 is 11.60% vs 229.75% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 9.67% vs 12.26% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 0.85% vs 160.79% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 14.73% vs 5.79% in Mar 2024

YoY Growth in year ended Mar 2025 is 136.12% vs 237.08% in Mar 2024