Compare Motil.Oswal.Fin. with Similar Stocks

Stock DNA

Capital Markets

INR 45,115 Cr (Mid Cap)

23.00

22

0.63%

1.22

15.73%

3.69

Total Returns (Price + Dividend)

Latest dividend: 5 per share ex-dividend date: Jan-31-2025

Risk Adjusted Returns v/s

Returns Beta

News

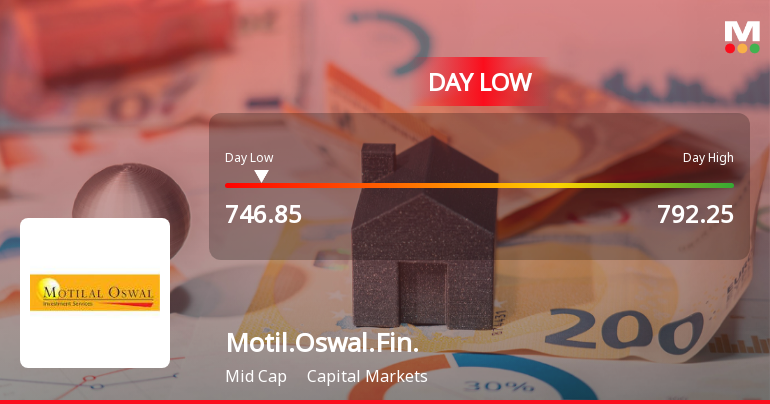

Motilal Oswal Financial Services Ltd Hits Intraday Low Amid Price Pressure

Motilal Oswal Financial Services Ltd experienced a notable decline today, touching an intraday low of Rs 749.15, reflecting a sharp price correction amid broader market pressures and sector underperformance.

Read full news article

Motilal Oswal Financial Services Ltd Faces Bearish Technical Shift Amid Mixed Momentum Signals

Motilal Oswal Financial Services Ltd (MOFSL) has experienced a notable shift in its technical momentum, with key indicators signalling a transition from mildly bearish to bearish trends. Despite a robust long-term performance relative to the Sensex, recent price action and technical parameters suggest caution for investors as the stock navigates a complex technical landscape.

Read full news article

Motilal Oswal Financial Services Ltd Forms Death Cross Signalling Bearish Trend

Motilal Oswal Financial Services Ltd has recently formed a Death Cross, a significant technical indicator where the 50-day moving average crosses below the 200-day moving average. This development signals a potential shift towards a bearish trend, reflecting deteriorating momentum and raising concerns about the stock's medium to long-term outlook.

Read full news article Announcements

Grant Of Employee Stock Options

27-Jan-2026 | Source : BSEThe Nomination and Remuneration Committee of the Board of Directors of the Company at its Meeting held on January 27 2026 has granted 437063 Stock Options to the eligible Employees under Motilal Oswal Financial Services Limited - Employee Stock Option Scheme - X.

Announcement under Regulation 30 (LODR)-Investor Presentation

27-Jan-2026 | Source : BSEPlease find enclosed herewith the Press Release & Investor(s)/Analyst(s) Presentation on the Financial & Operational Performance of the Company for the quarter and nine months ended December 31 2025.

Unaudited Financial Results (Standalone And Consolidated ) For The Quarter & Nine Months Ended December 31 2025

27-Jan-2026 | Source : BSEPlease find enclosed herewith the Financial Results for the quarter and nine months ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

Motilal Oswal Financial Services Ltd has declared 500% dividend, ex-date: 31 Jan 25

Motilal Oswal Financial Services Ltd has announced 1:5 stock split, ex-date: 25 Jul 08

Motilal Oswal Financial Services Ltd has announced 3:1 bonus issue, ex-date: 10 Jun 24

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 29 Schemes (5.48%)

Held by 255 FIIs (6.93%)

Raamdeo Ramgopal Agrawal (21.14%)

Navin Agarwal (5.08%)

10.32%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 5.93% vs 11.29% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 0.26% vs -14.45% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -11.04% vs 64.27% in Sep 2024

Growth in half year ended Sep 2025 is -23.85% vs 89.20% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -6.31% vs 45.02% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -18.55% vs 49.39% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 17.37% vs 70.09% in Mar 2024

YoY Growth in year ended Mar 2025 is 2.48% vs 162.00% in Mar 2024