Compare Ambuja Cements with Similar Stocks

Dashboard

Poor long term growth as Operating profit has grown by an annual rate -1.78% of over the last 5 years

- PAT(Q) At Rs 217.25 cr has Fallen at -89.9%

- CASH AND CASH EQUIVALENTS(HY) Lowest at Rs 458.50 cr

- PBDIT(Q) Lowest at Rs 1,353.07 cr.

With ROE of 10.3, it has a Expensive valuation with a 2.2 Price to Book Value

Stock DNA

Cement & Cement Products

INR 130,574 Cr (Large Cap)

33.00

39

0.39%

0.01

10.33%

2.24

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Jun-13-2025

Risk Adjusted Returns v/s

Returns Beta

News

Ambuja Cements Ltd Opens Strong with 4.6% Gap Up Amid Positive Market Sentiment

Ambuja Cements Ltd commenced trading on 3 Feb 2026 with a notable gap up, opening 4.6% higher than its previous close, signalling a strong start amid positive market momentum in the cement sector.

Read full news article

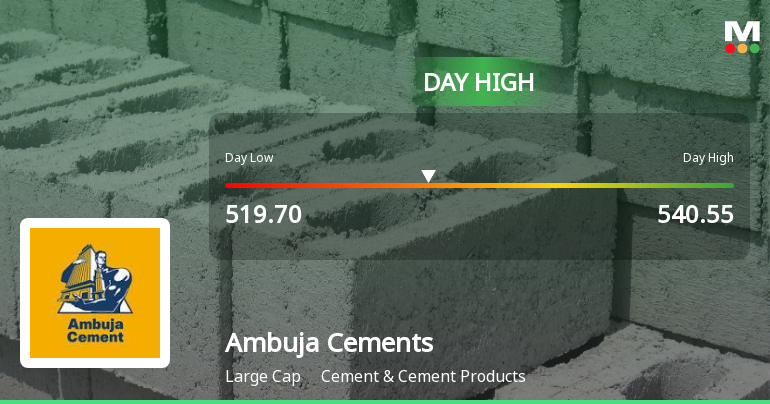

Ambuja Cements Ltd Hits Intraday High with 3.2% Surge on 3 Feb 2026

Ambuja Cements Ltd demonstrated robust intraday performance on 3 February 2026, surging to an intraday high of Rs 540.55, marking a 5.86% increase from its previous close. The stock outperformed its sector and broader market indices, reflecting notable trading momentum despite a mixed market environment.

Read full news article

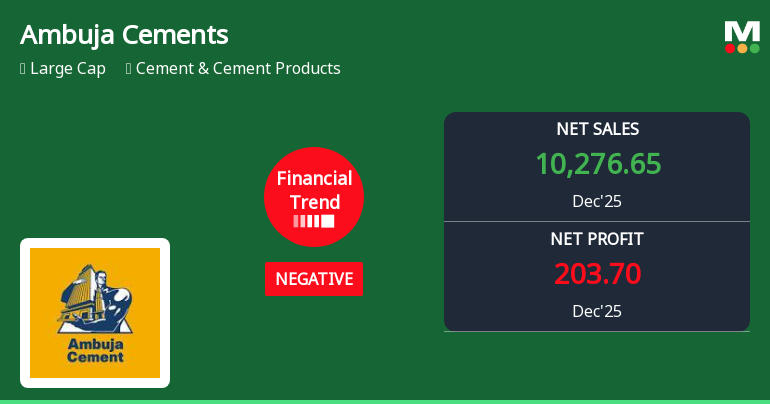

Ambuja Cements Ltd Reports Sharp Decline in Quarterly Performance Amid Negative Financial Trend

Ambuja Cements Ltd has reported a significant downturn in its December 2025 quarter results, marking a reversal from its previously positive financial trajectory. Key metrics including profit after tax, operating profit, and earnings per share have all contracted sharply, signalling mounting challenges for the cement producer amid a subdued industry backdrop.

Read full news article Announcements

Announcement Under Regulation 30 SEBI(LODR)2015

31-Jan-2026 | Source : BSEDisclosure under regulation 30 of SEBI (LODR) 2015 for Change in KMP for determining material events

Announcement under Regulation 30 (LODR)-Newspaper Publication

31-Jan-2026 | Source : BSECopy of newspaper publication for the extract of Consolidated Financial Results for the quarter and nine months ended on 31st December 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

31-Jan-2026 | Source : BSEAmbuja Cements Limited has informed the Exchange regarding link of Audio recording of Analyst/investors Meet

Corporate Actions

No Upcoming Board Meetings

Ambuja Cements Ltd has declared 100% dividend, ex-date: 13 Jun 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 52 Schemes (8.15%)

Held by 487 FIIs (5.8%)

Holderind Investments Ltd (47.97%)

Life Insurance Corporation Of India - Ulif004200910licend+grw512 (7.31%)

5.04%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 9.19% vs 15.78% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -90.56% vs 161.84% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 22.07% vs -1.19% in Sep 2024

Growth in half year ended Sep 2025 is 132.35% vs -34.10% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 17.29% vs 4.49% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -14.43% vs 29.92% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 6.56% vs -14.84% in Mar 2024

YoY Growth in year ended Mar 2025 is 20.42% vs 38.32% in Mar 2024