Compare Manali Petrochem with Similar Stocks

Dashboard

Poor long term growth as Operating profit has grown by an annual rate -4.43% of over the last 5 years

With ROE of 4.5, it has a Expensive valuation with a 0.9 Price to Book Value

Despite the size of the company, domestic mutual funds hold only 0.02% of the company

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Petrochemicals

INR 1,001 Cr (Micro Cap)

19.00

15

0.86%

-0.18

4.52%

0.87

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Sep-08-2025

Risk Adjusted Returns v/s

Returns Beta

News

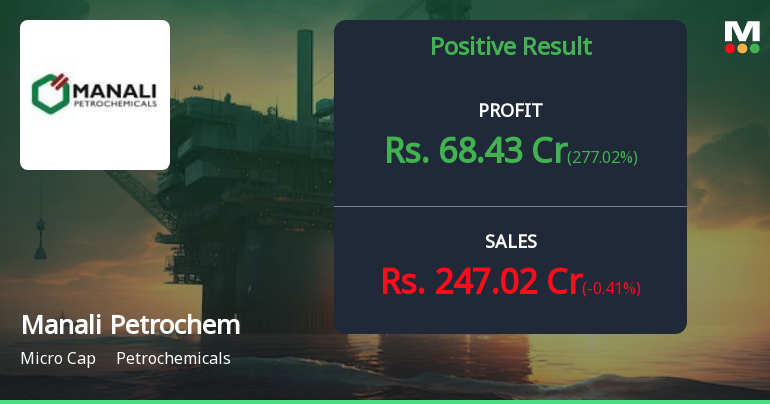

Are Manali Petrochemicals Ltd latest results good or bad?

Manali Petrochemicals Ltd's latest financial results for Q3 FY26 present a complex picture of the company's operational health. The company reported a net profit of ₹68.43 crore, reflecting a substantial year-on-year increase, but this growth is primarily attributed to a significant rise in other income, which constituted 91.28% of profit before tax. This heavy reliance on non-operating income raises concerns regarding the sustainability of earnings derived from core operations. In terms of net sales, Manali Petrochemicals recorded ₹247.02 crore, which indicates a slight sequential contraction of 0.41% from the previous quarter, although it shows a strong year-on-year growth of 25.95%. However, the operating profit, excluding other income, declined sharply by 31.08% quarter-on-quarter to ₹13.99 crore, leading to a contraction in operating margins to 5.66%. This decline in margins is significantly below his...

Read full news article

Manali Petrochemicals Q3 FY26: Extraordinary Other Income Masks Weak Operating Performance

Manali Petrochemicals Ltd., India's sole domestic manufacturer of Propylene Glycol and the largest producer of Propylene Oxide, reported a dramatic 277.02% quarter-on-quarter surge in net profit to ₹68.43 crores for Q3 FY26, driven almost entirely by exceptional other income rather than core operational strength. The micro-cap petrochemical manufacturer with a market capitalisation of ₹1,001 crores saw its stock trading at ₹58.18, down 28.17% from its 52-week high of ₹81.00, as investors grappled with deteriorating operating margins and mounting concerns about the sustainability of earnings quality.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Retirement

30-Jan-2026 | Source : BSELetter as attached

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

29-Jan-2026 | Source : BSEDetails of demat of shares

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

29-Jan-2026 | Source : BSEDetails of demat of shares.

Corporate Actions

(02 Feb 2026)

Manali Petrochemicals Ltd has declared 10% dividend, ex-date: 08 Sep 25

Manali Petrochemicals Ltd has announced 5:8 stock split, ex-date: 28 Sep 06

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 4 Schemes (0.01%)

Held by 25 FIIs (0.29%)

Sidd Life Sciences Private Limited (38.28%)

Mercantile Ventures Limited (2.39%)

39.19%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -0.41% vs 5.70% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 277.02% vs 26.57% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 2.56% vs -17.62% in Sep 2024

Growth in half year ended Sep 2025 is 145.76% vs -11.69% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 9.44% vs -14.09% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 445.81% vs 3.24% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -13.10% vs -12.30% in Mar 2024

YoY Growth in year ended Mar 2025 is 52.58% vs -62.09% in Mar 2024