Compare Wonderla Holiday with Similar Stocks

Dashboard

The company has declared Negative results for the last 7 consecutive quarters

- OPERATING CF(Y) Lowest at Rs 122.54 Cr

- PAT(Q) At Rs -1.75 cr has Fallen at -111.9%

- INVENTORY TURNOVER RATIO(HY) Lowest at 2.48 times

With ROE of 4.7, it has a Very Expensive valuation with a 1.8 Price to Book Value

Falling Participation by Institutional Investors

Below par performance in long term as well as near term

Stock DNA

Leisure Services

INR 3,138 Cr (Small Cap)

39.00

36

0.40%

-0.26

4.66%

1.79

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Aug-08-2025

Risk Adjusted Returns v/s

Returns Beta

News

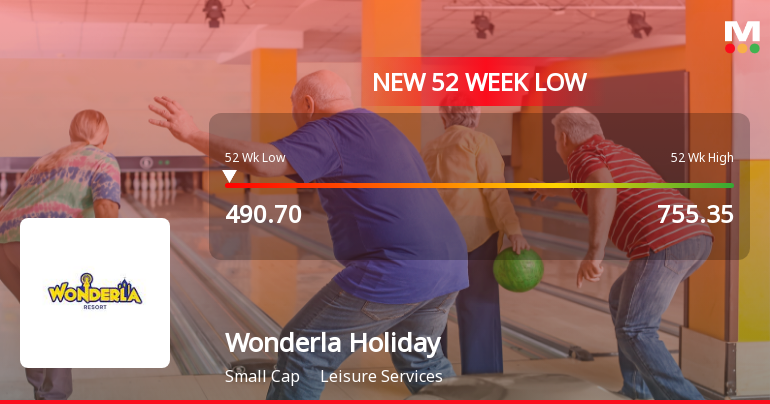

Wonderla Holidays Ltd Stock Hits 52-Week Low at Rs.489.9

Wonderla Holidays Ltd’s shares declined to a fresh 52-week low of Rs.489.9 on 30 Jan 2026, marking a significant milestone in the stock’s downward trajectory over the past year. This new low reflects ongoing pressures on the company’s financial performance amid broader market fluctuations.

Read full news article

Wonderla Holidays Ltd Stock Hits 52-Week Low at Rs.490.7

Shares of Wonderla Holidays Ltd, a key player in the Leisure Services sector, declined to a fresh 52-week low of Rs.490.7 on 28 Jan 2026, marking a significant milestone in the stock’s downward trajectory amid a challenging financial backdrop.

Read full news article

Wonderla Holidays Ltd Stock Hits 52-Week Low Amid Continued Downtrend

Shares of Wonderla Holidays Ltd have declined to a fresh 52-week low of Rs.490.7, marking a significant downturn amid a series of disappointing financial results and subdued market sentiment. The stock has underperformed its sector and broader indices, reflecting ongoing pressures within the leisure services industry.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

22-Jan-2026 | Source : BSEAnalyst or Investor meet

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

14-Jan-2026 | Source : BSEReconciliation of Share Capital Audit Report

Board Meeting Intimation for Approval Of Financial Results For The Quarter Ended December 31 2025.

14-Jan-2026 | Source : BSEWonderla Holidays Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 04/02/2026 inter alia to consider and approve Financial Results for the quarter ended December 31 2025.

Corporate Actions

04 Feb 2026

Wonderla Holidays Ltd has declared 20% dividend, ex-date: 08 Aug 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 4 Schemes (10.12%)

Held by 59 FIIs (5.49%)

Arun K Chittilappilly (31.87%)

Tata Mutual Fund - Tata Small Cap Fund (6.78%)

16.96%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 18.95% vs -10.35% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -111.89% vs 8.88% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 3.38% vs -7.51% in Sep 2024

Growth in half year ended Sep 2025 is -34.80% vs -20.45% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -5.63% vs 16.64% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -27.41% vs 18.89% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -5.07% vs 12.54% in Mar 2024

YoY Growth in year ended Mar 2025 is -30.82% vs 6.08% in Mar 2024