Compare XPRO India with Similar Stocks

Dashboard

Poor long term growth as Net Sales has grown by an annual rate of 12.01% and Operating profit at 0.48% over the last 5 years

The company has declared Negative results for the last 5 consecutive quarters

With ROE of 2, it has a Very Expensive valuation with a 3.5 Price to Book Value

Despite the size of the company, domestic mutual funds hold only 1.41% of the company

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Jul-18-2025

Risk Adjusted Returns v/s

Returns Beta

News

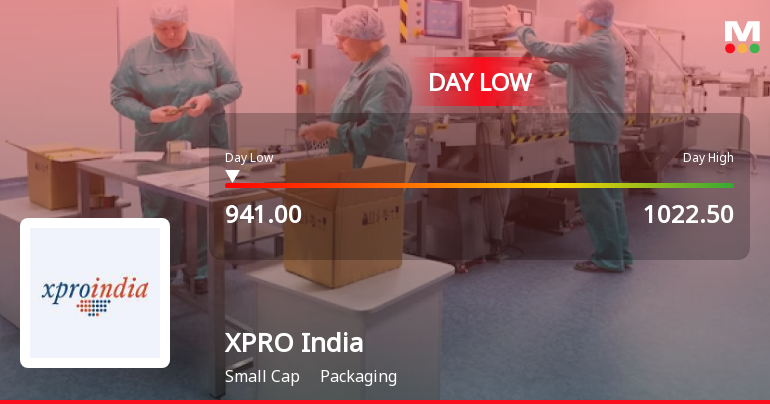

XPRO India Ltd Hits Intraday Low Amid Price Pressure, Declines 7.03%

Shares of XPRO India Ltd, a key player in the packaging sector, declined sharply today, touching an intraday low of Rs 950, reflecting sustained price pressure and subdued market sentiment. The stock underperformed its sector and broader indices, continuing a recent downward trend amid challenging trading conditions.

Read full news articleWhen is the next results date for XPRO India Ltd?

The next results date for XPRO India Ltd is scheduled for 04 February 2026....

Read full news article

XPRO India Ltd Surges to Intraday High with 7.21% Gain on 28 Jan 2026

XPRO India Ltd demonstrated robust intraday performance on 28 Jan 2026, surging to an intraday high of Rs 1,069.55, marking a 7.33% increase from its previous close. The stock closed the day with a notable gain of 7.21%, outperforming its sector and broader market indices.

Read full news article Announcements

Board Meeting Intimation for Consideration And Approval Of Un-Audited Standalone And Consolidated Financial Results Of The Company For The Quarter Ended December 31 2025

27-Jan-2026 | Source : BSEXpro India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 04/02/2026 inter alia to consider and approve Un-Audited Standalone And Consolidated Financial Results Of The Company For The Quarter Ended December 31 2025

Announcement under Regulation 30 (LODR)-Credit Rating

14-Jan-2026 | Source : BSECredit Rating

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECertificate under Regulation 74(5) of SEBI(Depositories and Participants) Regulations 2018 for the quarter ended on December 31 2025

Corporate Actions

04 Feb 2026

XPRO India Ltd has declared 20% dividend, ex-date: 18 Jul 25

No Splits history available

XPRO India Ltd has announced 1:2 bonus issue, ex-date: 01 Jul 22

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 7 Schemes (0.84%)

Held by 25 FIIs (14.63%)

Ipro Capital Limited (18.79%)

Malabar India Fund Limited (11.33%)

29.29%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -10.50% vs 21.83% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -50.00% vs 4.85% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -2.83% vs 13.14% in Sep 2024

Growth in half year ended Sep 2025 is -102.13% vs 15.36% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 11.89% vs -12.85% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -0.06% vs -23.46% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 15.01% vs -8.92% in Mar 2024

YoY Growth in year ended Mar 2025 is -13.40% vs -3.26% in Mar 2024