Compare Kiduja India with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 53 Cr (Micro Cap)

NA (Loss Making)

22

0.00%

-4.29

27.52%

-2.23

Total Returns (Price + Dividend)

Kiduja India for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Kiduja India Ltd latest results good or bad?

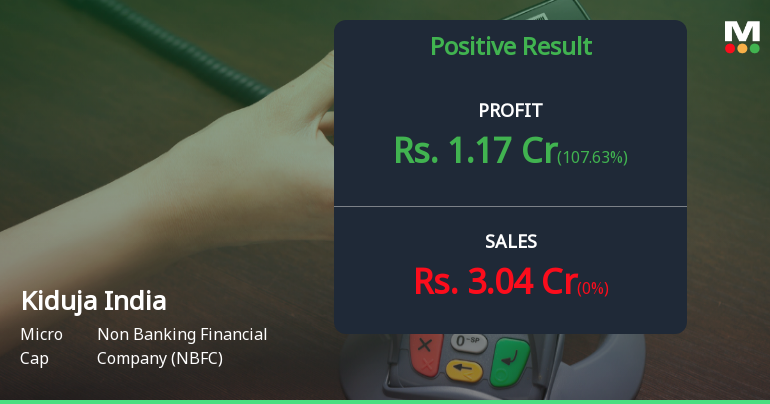

Kiduja India Ltd's latest financial results for Q3 FY26 present a complex picture. The company reported net sales of ₹3.04 crores, a notable recovery from zero revenue in the previous quarter (Q2 FY26), but still significantly lower than the ₹19.12 crores achieved in Q1 FY26. This volatility in revenue generation raises concerns about the sustainability of its business model, which has historically demonstrated erratic performance. The net profit for Q3 FY26 was ₹1.17 crores, marking a reversal from a loss of ₹15.33 crores in Q2 FY26. While this profit is a positive development, it must be contextualized against the company's negative shareholder funds of ₹-23.66 crores, which have worsened from ₹-20.40 crores a year earlier. The operating margin of 87.83% appears strong, but it is largely driven by the minimal revenue base, making it less meaningful in assessing overall financial health. The company's ba...

Read full news article

Kiduja India Q3 FY26: Turnaround Attempt Amid Persistent Structural Challenges

Kiduja India Ltd., a Mumbai-based non-banking financial company, reported a modest quarterly profit of ₹1.17 crores in Q3 FY26, marking a sharp reversal from the ₹15.33 crore loss recorded in Q2 FY26. However, this micro-cap NBFC with a market capitalisation of just ₹53.00 crores continues to grapple with deep-seated structural challenges, including a negative book value of ₹-9.86 per share and erratic revenue generation that has plagued the company for years. Following the results announcement, the stock traded at ₹22.16, up 4.97% on the day, though it remains down 37.33% over the past year.

Read full news article

Kiduja India Ltd is Rated Strong Sell

Kiduja India Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 27 Oct 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 03 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Board Meeting Intimation for Considering And Approving The Unaudited Financial Results Of The Company Along With Limited Review Report For The Quarter And Nine Months Ended 31St December 2025.

23-Jan-2026 | Source : BSEKiduja India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 03/02/2026 inter alia to consider and approve the Unaudited Financial Results of the Company along with Limited Review Report for the quarter and nine months ended 31st December 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSEPlease find enclosed the certificate received from M/s. MUFG Intime India Private Limited dated 01st January 2026.

Closure of Trading Window

26-Dec-2025 | Source : BSEPlease find enclosed intimation regarding the closure of trading window.

Corporate Actions

(03 Feb 2026)

No Dividend history available

Kiduja India Ltd has announced 1:10 stock split, ex-date: 31 Jan 25

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Ashish Jaipuria (55.0%)

Amit Babulal Agarwal (2.29%)

22.17%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 0.00% vs -100.00% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 107.63% vs -194.40% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -66.96% vs 28.56% in Sep 2024

Growth in half year ended Sep 2025 is -91.99% vs 3.89% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -51.14% vs -44.88% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 196.31% vs -107.97% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -85.99% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -118.44% vs 613.46% in Mar 2024