Compare N K Industries with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -6.59% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

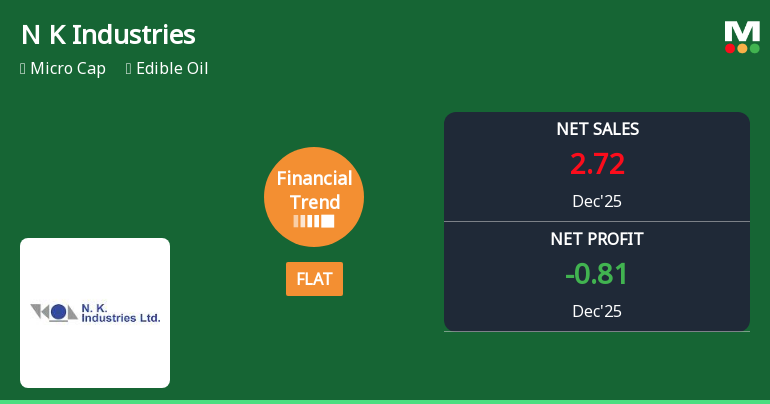

Flat results in Dec 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Edible Oil

INR 42 Cr (Micro Cap)

NA (Loss Making)

33

0.00%

0.00

1.66%

-0.12

Total Returns (Price + Dividend)

N K Industries for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

N K Industries Ltd is Rated Strong Sell

N K Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 14 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 06 February 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news articleAre N K Industries Ltd latest results good or bad?

N K Industries Ltd has reported its financial results for the third quarter of FY26, revealing significant challenges across multiple operational metrics. The company recorded net sales of ₹2.72 crores, reflecting a decline of 24.02% from the previous quarter and a year-on-year decrease of 29.53%. This persistent revenue contraction indicates ongoing difficulties in maintaining sales momentum. The net profit for the quarter was a loss of ₹0.81 crores, which represents a substantial deterioration of 88.37% compared to the same quarter last year. This loss marks a continuation of the company's trend of negative profitability, with operating margins turning negative at -3.47%, contrasting sharply with a positive margin of 4.81% in the prior year. The operational loss of ₹0.09 crores further underscores the challenges in managing costs amidst declining revenues. The company's balance sheet reveals severe stru...

Read full news article

N K Industries Ltd Reports Flat Quarterly Performance Amid Financial Trend Stabilisation

N K Industries Ltd, a micro-cap player in the edible oil sector, reported a flat financial performance for the quarter ended December 2025, marking a notable improvement from its prior negative trend. Despite persistent challenges in operational efficiency and debtor management, the company’s recent quarterly results suggest a stabilisation phase, though margin pressures and liquidity concerns remain key issues for investors to monitor closely.

Read full news article Announcements

Financial Results For The Quarter And 9 Months Ended On 31St December 2025.

04-Feb-2026 | Source : BSEIn continuation to our communication dated 28th January 2026 informing the date of Board Meeting. The Board of Directors of the Company at its meeting held today inter alia considered and approved the following: 1. Unaudited Standalone & Consolidated Financial Results for the quarter and 9 months ended on 31st December 2025. 2. Limited Review Report on the Standalone and Consolidated Financial Results for the quarter and 9 months ended on 31st December 2025. The meeting of Board of Directors of the Company commenced at 3:30 P.M. and the meeting concluded at 5:00 P.M. We request you to kindly take the above information on your record.

Board Meeting Outcome for Outcome Of Board Meeting Held On Wednesday 4Th February 2026

04-Feb-2026 | Source : BSEIn continuation to our communication dated 28th January 2026 informing the date of Board Meeting. The Board of Directors of the Company at its meeting held today inter alia considered and approved the following: 1. Unaudited Standalone & Consolidated Financial Results for the quarter and 9 months ended on 31st December 2025. 2. Limited Review Report on the Standalone and Consolidated Financial Results for the quarter and 9 months ended on 31st December 2025. The meeting of Board of Directors of the Company commenced at 3:30 P.M. and the meeting concluded at 5:00 P.M. We request you to kindly take the above information on your record.

Board Meeting Intimation for Prior Intimation Of Board Meeting Pursuant To Regulation 29(1) (A) Of Listing Regulations 2015 Is To Inform That The Meeting Of The Board Of Directors Of The Company Is Scheduled To Be Held On 4Th February 2026 I.E. Wednesda

28-Jan-2026 | Source : BSENK Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 04/02/2026 inter alia to consider and approve inter alia consider the following agenda: 1. To consider and approve the Standalone and Consolidated Unaudited Financial Results of the Company under Regulation 33 of Listing Regulations 2015 for the Quarter ended on 31st December 2025. 2. Any other business as may be considered fit and proper by the Chair.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Aashita Nileshbhai Patel (21.2%)

Bhavna Darshan Mehta (2.48%)

24.9%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -24.02% vs -8.67% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 60.10% vs -194.20% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -10.39% vs -10.19% in Sep 2024

Growth in half year ended Sep 2025 is -491.30% vs 68.71% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -16.43% vs -11.12% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -296.63% vs 52.41% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -14.76% vs 8.53% in Mar 2024

YoY Growth in year ended Mar 2025 is -244.66% vs 44.62% in Mar 2024