Compare Roopa Industries with Similar Stocks

Stock DNA

Pharmaceuticals & Biotechnology

INR 38 Cr (Micro Cap)

20.00

33

0.00%

1.88

10.52%

2.07

Total Returns (Price + Dividend)

Roopa Industries for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Roopa Industries Ltd is Rated Strong Sell

Roopa Industries Ltd is rated 'Strong Sell' by MarketsMOJO, with this rating last updated on 07 July 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 04 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article

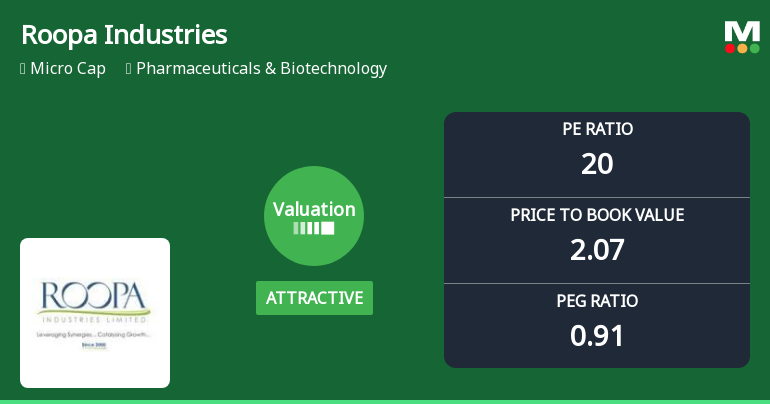

Roopa Industries Ltd Valuation Shifts Signal Renewed Price Attractiveness Amid Mixed Returns

Roopa Industries Ltd, a player in the Pharmaceuticals & Biotechnology sector, has seen a notable shift in its valuation parameters, moving from very attractive to attractive territory. Despite a recent upgrade in valuation grades, the company’s overall market performance remains mixed, with significant divergence from benchmark indices such as the Sensex. This article analyses the evolving price attractiveness of Roopa Industries, comparing its key valuation metrics against historical averages and peer companies to provide a comprehensive investment perspective.

Read full news article

Roopa Industries Ltd Falls to 52-Week Low of Rs.41 Amidst Continued Downtrend

Roopa Industries Ltd’s shares touched a fresh 52-week low of Rs.41 today, marking a significant decline amid a sustained downward trend. The stock has underperformed its sector and broader market indices, reflecting ongoing concerns about its financial health and valuation metrics.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

17-Jan-2026 | Source : BSESubmission of Compliance Certificate under Reg 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31/12/2026

Submission Of Report On Re-Lodgement Of Transfer Requests Of Physical Shares Under Special Window

16-Jan-2026 | Source : BSEReport on re-lodgement of transfer requests of physical shares under Special Window for the period 1st December 2025 to 6th January 2026

Announcement under Regulation 30 (LODR)-Newspaper Publication

10-Jan-2026 | Source : BSEPublication of Notice to Shareholders

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 1 FIIs (0.25%)

Star Niochem Pvt Limited (18.91%)

Sangeetha S (9.51%)

40.92%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -18.05% vs 17.57% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 64.29% vs -33.33% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 6.15% vs 106.60% in Sep 2024

Growth in half year ended Sep 2025 is -12.79% vs 7.50% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 87.94% vs -17.08% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 51.40% vs -4.46% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 71.36% vs -7.54% in Mar 2024

YoY Growth in year ended Mar 2025 is 33.55% vs 12.59% in Mar 2024