Compare Sadhana Nitro with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 10.55 times

- The company has been able to generate a Return on Equity (avg) of 3.78% signifying low profitability per unit of shareholders funds

With a fall in EPS of -2182.91%, the company declared Very Negative results in Sep 25

Risky - Negative Operating Profits

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Commodity Chemicals

INR 198 Cr (Micro Cap)

NA (Loss Making)

39

1.66%

1.00

-8.30%

0.79

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Sep-22-2025

Risk Adjusted Returns v/s

Returns Beta

News

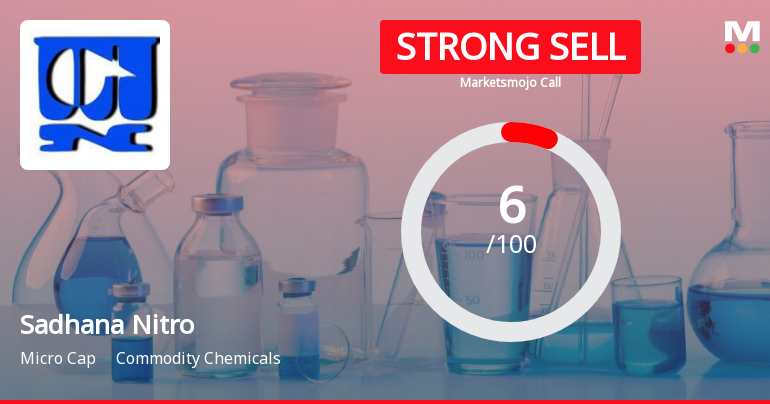

Sadhana Nitro Chem Ltd is Rated Strong Sell

Sadhana Nitro Chem Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 13 August 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 28 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article

Sadhana Nitro Chem Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Sadhana Nitro Chem Ltd, a micro-cap player in the commodity chemicals sector, witnessed a sharp decline on 23 Jan 2026, hitting its lower circuit limit and closing at a new 52-week and all-time low of ₹5.59. The stock underperformed its sector and the broader market amid intense selling pressure, reflecting growing investor concerns and a deteriorating outlook.

Read full news article

Sadhana Nitro Chem Ltd is Rated Strong Sell

Sadhana Nitro Chem Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 13 Aug 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 05 January 2026, providing investors with the most recent and relevant data to assess the stock’s outlook.

Read full news article Announcements

Shareholder Meeting / Postal Ballot-Scrutinizers Report

16-Jan-2026 | Source : BSEIn accordance with the provisions of section 110 of Companies Act 2013 read with rules framed thereunder and Regulation 44 of the SEBI (LODR) Regulations 2015 the Company had provided remote e-voting facility to its Shareholders on resolution as set out in the Postal Ballot Notice for their approval. As per the Scrutinizers Report the shareholders of the Company have approved the Resolutions as mentioned in the Postal Ballot Notice dated December 12 2025.

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

16-Jan-2026 | Source : BSEIn accordance with the provisions of section 110 of the Companies Act 2013 read with rules framed thereunder and regulation 44 of SEBI (LODR) Regulations 2015 the Company had provided remote e-voting facility to its shareholder on resolution set out in the Postal Ballot Notice for their approval. As per the Scrutinizers Report the Shareholders of the Company have approved the Resolutions as mentioned in the Postal Ballot Notice dated 12 December 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

12-Jan-2026 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31 December 2025

Corporate Actions

No Upcoming Board Meetings

Sadhana Nitro Chem Ltd has declared 10% dividend, ex-date: 22 Sep 25

Sadhana Nitro Chem Ltd has announced 1:5 stock split, ex-date: 03 Apr 20

Sadhana Nitro Chem Ltd has announced 2:9 bonus issue, ex-date: 05 Jul 23

Sadhana Nitro Chem Ltd has announced 1:3 rights issue, ex-date: 13 Sep 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

4.1733

Held by 2 Schemes (0.0%)

Held by 4 FIIs (0.14%)

Asit Javeri (14.75%)

Badjate Stock Broking Private Ltd (2.26%)

54.08%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -90.39% vs -43.20% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -1,105.19% vs -151.71% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -61.00% vs -3.00% in Sep 2024

Growth in half year ended Sep 2025 is -3,243.18% vs -66.54% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -7.51% vs 31.87% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -2.81% vs 154.29% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -12.89% vs 32.60% in Mar 2024

YoY Growth in year ended Mar 2025 is 85.29% vs 28.71% in Mar 2024