Compare Chola Financial with Similar Stocks

Dashboard

High Debt company with Weak Long Term Fundamental Strength

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

- The company has been able to generate a Return on Capital Employed (avg) of 9.89% signifying low profitability per unit of total capital (equity and debt)

Flat results in Sep 25

Stock DNA

Non Banking Financial Company (NBFC)

INR 32,345 Cr (Mid Cap)

14.00

22

0.08%

12.91

16.30%

2.28

Total Returns (Price + Dividend)

Latest dividend: 1.3 per share ex-dividend date: Aug-01-2025

Risk Adjusted Returns v/s

Returns Beta

News

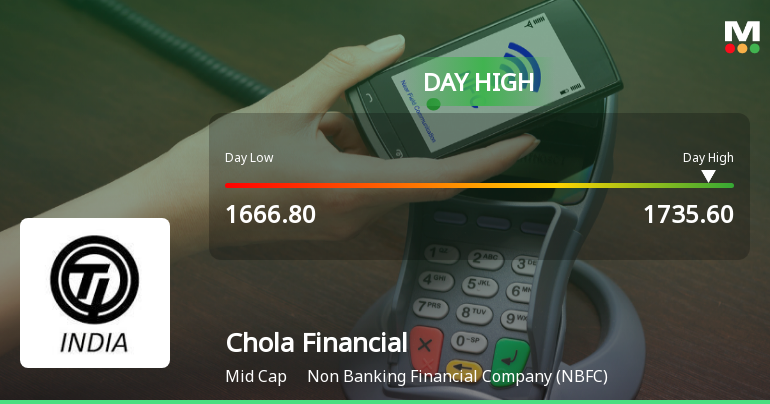

Cholamandalam Financial Holdings Ltd Hits Intraday High with 5.21% Surge

Cholamandalam Financial Holdings Ltd recorded a robust intraday performance on 3 Feb 2026, surging to a day’s high of Rs 1,733.2, marking a 5.22% increase. This strong uptick outpaced both its sector and the broader market, reflecting notable trading momentum amid a mixed market backdrop.

Read full news article

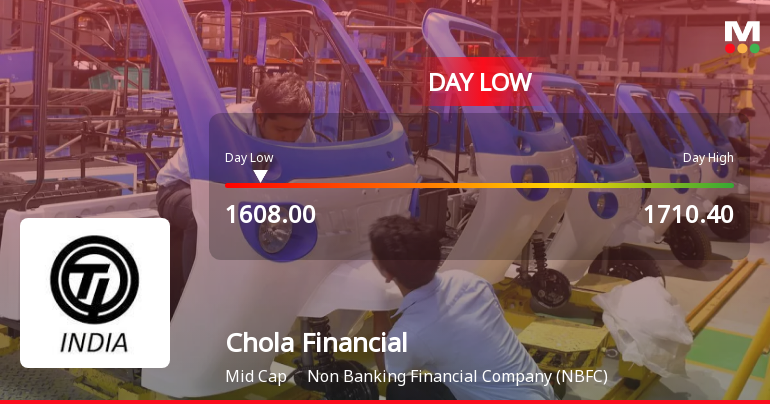

Cholamandalam Financial Holdings Ltd Hits Intraday Low Amid Price Pressure

Shares of Cholamandalam Financial Holdings Ltd declined sharply today, touching an intraday low of Rs 1,610, reflecting significant price pressure and a reversal after a four-day rally. The stock underperformed its sector and broader market indices, weighed down by persistent selling and technical weaknesses.

Read full news article

Cholamandalam Financial Holdings Ltd is Rated Strong Sell

Cholamandalam Financial Holdings Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 07 Jan 2026. However, the analysis and financial metrics presented here reflect the stock's current position as of 29 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Board Meeting Intimation for Un-Audited Financial Results

14-Jan-2026 | Source : BSECholamandalam Financial Holdings Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 09/02/2026 inter alia to consider and approve un-audited financial results for the quarter and nine-months ended December 31 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Jan-2026 | Source : BSECholamandalam Financial Holdings Limited has informed the exchange regarding certificate under Regulation 74(5) of SEBI(Depository Participants) Regulations 2018 for the quarter ended 31st December 2025.

Closure of Trading Window

02-Jan-2026 | Source : BSECholamandalam Financial Holdings Limited has informed the exchange regarding Closure of Trading Window pursuant to SEBI(Prohibition of Insider Trading) Regulations 2015.

Corporate Actions

09 Feb 2026

Cholamandalam Financial Holdings Ltd has declared 130% dividend, ex-date: 01 Aug 25

Cholamandalam Financial Holdings Ltd has announced 2:10 stock split, ex-date: 31 May 06

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

0.0152

Held by 31 Schemes (21.06%)

Held by 271 FIIs (16.47%)

Ambadi Investments Limited (37.69%)

Nippon Life India Trustee Ltd-a/c Nippon India Nif (4.6%)

9.66%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 1.78% vs 4.30% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -4.94% vs -5.72% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 19.30% vs 31.65% in Sep 2024

Growth in half year ended Sep 2025 is 5.08% vs 35.54% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 29.22% vs 44.58% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 23.87% vs 42.72% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 28.38% vs 42.20% in Mar 2024

YoY Growth in year ended Mar 2025 is 22.63% vs 37.38% in Mar 2024