Compare Cochin Malabar with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of % and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

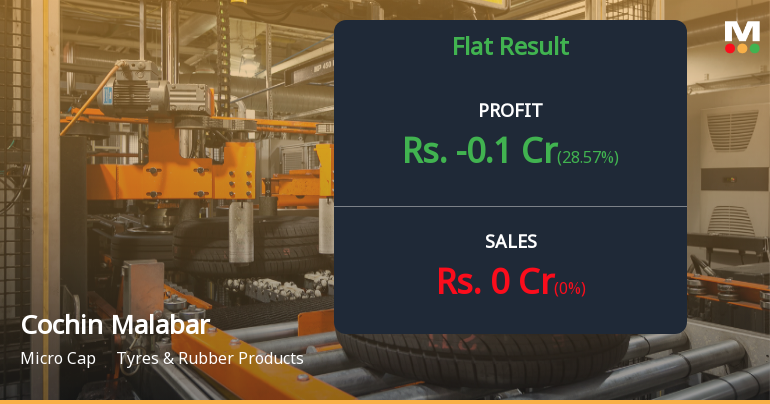

Flat results in Dec 25

Risky - Negative EBITDA

Underperformed the market in the last 1 year

Stock DNA

Tyres & Rubber Products

INR 26 Cr (Micro Cap)

20.00

49

0.00%

-1.85

-69.19%

-13.89

Total Returns (Price + Dividend)

Cochin Malabar for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Cochin Malabar Estates & Industries Ltd latest results good or bad?

Cochin Malabar Estates & Industries Ltd's latest financial results for Q3 FY26 reveal significant operational challenges. The company reported a net loss of ₹0.10 crores, which reflects a sequential deterioration from the previous quarter's loss of ₹0.09 crores. Notably, the company has not generated any sales revenue throughout the current fiscal year, indicating a concerning operational shutdown or severe issues affecting its plantation activities. The operating loss (PBDIT) for the quarter was ₹0.03 crores, worsening from a loss of ₹0.02 crores in Q2 FY26. Interest expenses remained stable at ₹0.10 crores, which, in the absence of revenue, poses a significant burden on the company's financial health. The persistent losses over seven consecutive quarters, excluding a one-time gain in the previous fiscal year, highlight structural issues rather than temporary setbacks. Cochin Malabar's balance sheet pre...

Read full news article

Cochin Malabar Estates & Industries Q3 FY26: Losses Deepen as Operational Challenges Mount

Cochin Malabar Estates & Industries Ltd., a micro-cap plantation company with operations in Kerala and Karnataka, reported a net loss of ₹0.10 crores for Q3 FY26 (October-December 2025), marking a marginal deterioration from the ₹0.09 crores loss in the previous quarter. The company, valued at just ₹25.00 crores, continues to grapple with operational challenges that have plagued its performance throughout the fiscal year, with zero revenue generation across all reported quarters.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

06-Feb-2026 | Source : BSESubmission of Newspaper Advertisement of Unaudited Financial Results of the Company for the quarter and nine months ended 31st December 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

06-Feb-2026 | Source : BSESubmission of Newspaper Advertisement of Unaudited Financial Results of the Company for the quarter and nine months ended 31st December 2025.

Board Meeting Outcome for Unaudited Financial Results For The Quarter And Nine Months Ended 31St December 2025.

05-Feb-2026 | Source : BSEPursuant to Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we enclose a copy of the Unaudited Financial Results of the Company for the Quarter and Nine Months ended 31st December 2025 approved at the meeting of the Board of Directors of the Company held on 5th February 2026. A copy of the Limited Review Report of the Auditors of the Company in respect of the said results is also enclosed. The Board Meeting commenced at 15.00 P.M. and concluded at 16.30 P.M.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Shri Vasuprada Plantations Limited (24.68%)

Life Insurance Corporation Of India (16.77%)

18.91%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 0.00% vs 0.00% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 28.57% vs 6.67% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 35.48% vs 11.43% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.00% vs 0.00% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 33.33% vs 10.00% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 156.00% vs 176.92% in Mar 2024