Compare India Gelatine with Similar Stocks

Stock DNA

Specialty Chemicals

INR 234 Cr (Micro Cap)

10.00

39

1.47%

-0.35

12.54%

1.33

Total Returns (Price + Dividend)

Latest dividend: 5 per share ex-dividend date: Sep-16-2025

Risk Adjusted Returns v/s

Returns Beta

News

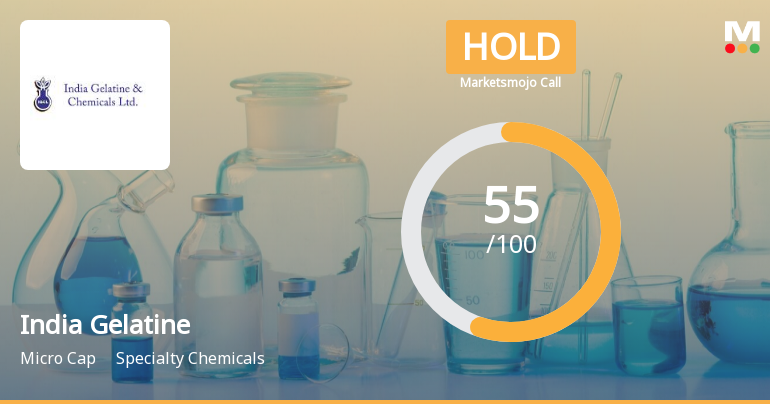

India Gelatine & Chemicals Ltd is Rated Hold

India Gelatine & Chemicals Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 28 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

India Gelatine & Chemicals Ltd is Rated Hold

India Gelatine & Chemicals Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 15 Dec 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 07 January 2026, providing investors with an up-to-date view of its fundamentals, returns, and market standing.

Read full news article

India Gelatine & Chemicals Ltd is Rated Hold

India Gelatine & Chemicals Ltd is rated 'Hold' by MarketsMOJO. This rating was last updated on 15 Dec 2025, reflecting a shift from the previous 'Sell' grade. However, the analysis below presents the stock's current fundamentals, returns, and financial metrics as of 27 December 2025, providing investors with an up-to-date perspective on the company’s position.

Read full news article Announcements

Board Meeting Intimation for Intimation Of Board Meeting Pursuant To Regulation 29 Of SEBI (Listing Obligation And Disclosure Requirements) Regulations 2015.

30-Jan-2026 | Source : BSEIndia Gelatine & Chemicals Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve Pursuant to Regulation 29 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform that a meeting of the Board of Directors of the Company is scheduled to be held on Tuesday February 10 2026 inter alia to consider and approve the Un-audited Financial Results of the Company for the quarter ended December 31 2025.

Announcement under Regulation 30 (LODR)-Change in Management

24-Jan-2026 | Source : BSEMs. Vishakha Hasmukh Purohit has resigned from the post of CFO with effect from close of Business hours 31st January 2026.

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

14-Jan-2026 | Source : BSEOutcome of Postal Ballot and submission of voting results under Reg.30 & Reg.44 of SEBI(LODR) Regulation 2025.

Corporate Actions

10 Feb 2026

India Gelatine & Chemicals Ltd has declared 50% dividend, ex-date: 16 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Ashok Matches And Timber Industries Private Limited (27.28%)

Sangeetha S (2.81%)

26.49%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 19.95% vs -26.45% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -9.04% vs 23.99% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -7.34% vs -13.07% in Sep 2024

Growth in half year ended Sep 2025 is 66.30% vs -47.75% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -5.98% vs 4.02% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -49.98% vs 60.18% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -3.55% vs 0.31% in Mar 2024

YoY Growth in year ended Mar 2025 is -38.75% vs 18.79% in Mar 2024