Compare Gorani Industrie with Similar Stocks

Stock DNA

Electronics & Appliances

INR 28 Cr (Micro Cap)

24.00

41

0.00%

0.89

8.55%

2.05

Total Returns (Price + Dividend)

Gorani Industrie for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

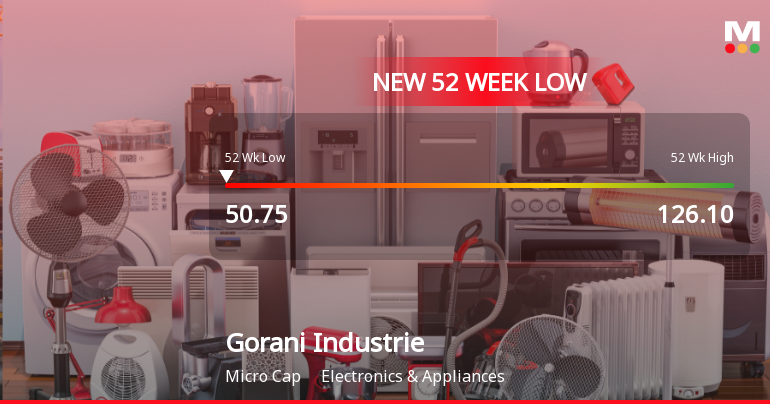

Gorani Industries Ltd Stock Falls to 52-Week Low of Rs.50.75

Gorani Industries Ltd, a player in the Electronics & Appliances sector, recorded a fresh 52-week low of Rs.50.75 today, marking a significant decline amid broader market fluctuations. The stock underperformed its sector by 5.76% and closed with a day’s loss of 6.02%, reflecting ongoing pressures on its valuation and market sentiment.

Read full news article

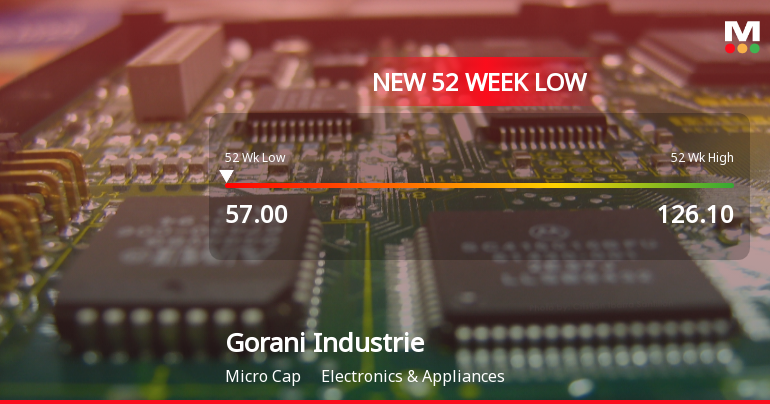

Gorani Industries Ltd Falls to 52-Week Low of Rs 57 Amid Continued Underperformance

Gorani Industries Ltd, a player in the Electronics & Appliances sector, has touched a new 52-week low of Rs.57 today, marking a significant decline in its stock price amid ongoing challenges and persistent underperformance relative to market benchmarks.

Read full news article

Gorani Industries Ltd Stock Hits 52-Week Low at Rs.58

Shares of Gorani Industries Ltd have declined to a fresh 52-week low of Rs.58, marking a significant downturn amid a broader market environment that remains relatively stable. The stock’s recent performance reflects ongoing pressures within the Electronics & Appliances sector, with the company’s valuation and financial metrics drawing close scrutiny.

Read full news article Announcements

Board Meeting Intimation for For Considering And Approving Un-Audited Financial Results For The Quarter Ended On December 31 2025.

30-Jan-2026 | Source : BSEGorani Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve un-audited financial results for the quarter ended on December 31 2025.

Announcement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

30-Jan-2026 | Source : BSEGorani Industries Limited hereby submits intimation regarding resignation of Company Secretary & Compliance Officer with effect from closure of business hours on February 13 2026.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSEGorani Industries Limited hereby submits Certificate received from M/s MUFG Intime India Private Limited (formerly known as M/s. Link Intime India Private Limited) Registrar and Share Transfer Agent of the Company under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018.

Corporate Actions

13 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Sanjay Gorani (19.61%)

Online Appliances Llp (15.68%)

19.77%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -26.01% vs 61.81% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -32.00% vs -26.47% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -11.29% vs 14.36% in Sep 2024

Growth in half year ended Sep 2025 is 290.91% vs -84.93% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 16.50% vs -9.91% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -32.47% vs -63.51% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 1.58% vs 0.64% in Mar 2024

YoY Growth in year ended Mar 2025 is -36.76% vs -9.33% in Mar 2024