Compare Haryana Capfin with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 77 Cr (Micro Cap)

16.00

22

0.00%

0.00

1.63%

0.25

Total Returns (Price + Dividend)

Haryana Capfin for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

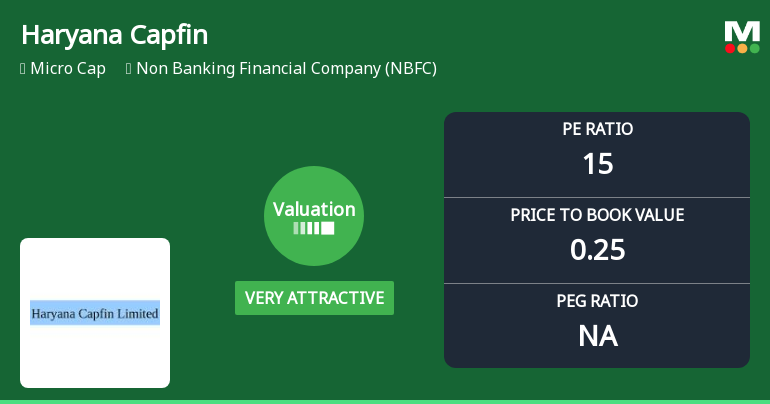

Haryana Capfin Ltd Valuation Shifts to Very Attractive Amidst Market Challenges

Haryana Capfin Ltd, a Non-Banking Financial Company (NBFC), has seen a significant shift in its valuation parameters, moving from an attractive to a very attractive rating. Despite recent price pressures and a challenging market environment, the company’s price-to-earnings (P/E) and price-to-book value (P/BV) ratios now present compelling valuation opportunities compared to historical averages and peer benchmarks.

Read full news article

Haryana Capfin Ltd is Rated Strong Sell

Haryana Capfin Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 15 Dec 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 30 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Haryana Capfin Ltd is Rated Strong Sell

Haryana Capfin Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 15 Dec 2025. However, all fundamentals, returns, and financial metrics discussed here reflect the company’s current position as of 19 January 2026, providing investors with the latest insights into the stock’s performance and outlook.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECertificate under regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st December 2025

Closure of Trading Window

24-Dec-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

29-Nov-2025 | Source : BSENewspaper advertisement informing shareholders regarding opening of Special Window for Re-lodgment of Transfer requests of Physical Shares.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 1 FIIs (0.81%)

Sudha Apparels Limited (19.47%)

Daniel Vyappar Private Limited (4.73%)

17.09%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 2,530.43% vs -48.89% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 10,950.00% vs -85.71% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -4.56% vs 82.27% in Sep 2024

Growth in half year ended Sep 2025 is -5.11% vs 90.28% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 76.12% vs 74.78% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 82.96% vs 95.65% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 71.53% vs 60.22% in Mar 2024

YoY Growth in year ended Mar 2025 is 85.11% vs 79.62% in Mar 2024