Compare Sita Enterprises with Similar Stocks

Stock DNA

Trading & Distributors

INR 46 Cr (Micro Cap)

12.00

22

0.00%

0.00

20.21%

2.38

Total Returns (Price + Dividend)

Sita Enterprises for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

When is the next results date for Sita Enterprises Ltd?

The next results date for Sita Enterprises Ltd is scheduled for 03 February 2026....

Read full news article

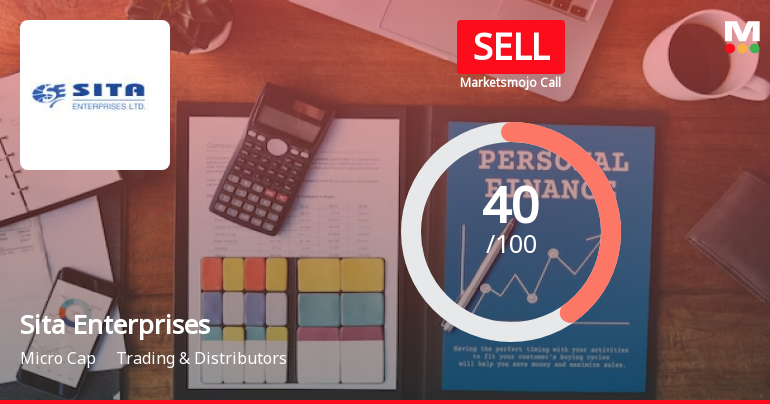

Sita Enterprises Ltd is Rated Sell

Sita Enterprises Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 19 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 26 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Sita Enterprises Ltd is Rated Sell

Sita Enterprises Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 19 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 26 December 2025, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Board Meeting Intimation for Unaudited Financial Results

27-Jan-2026 | Source : BSESita Enterprises Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 03/02/2026 inter alia to consider and approve and take on record the unaudited Standalone Financial Results of the Company for the quarter ended 31 December 2025 and to transact any other business as may be specified in the agenda

Intimation Of Change In Email ID And Contact Number.

23-Jan-2026 | Source : BSEPlease find enclosed file.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSEPlease find enclosed compliance certificate.

Corporate Actions

(03 Feb 2026)

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Jitendra Rasiklal Sanghavi (71.76%)

Sanju Ashok Tulsyan (2.13%)

24.92%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 748.39% vs -75.97% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 990.00% vs -83.33% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 187.35% vs -14.87% in Sep 2024

Growth in half year ended Sep 2025 is 215.15% vs -25.84% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -66.54% vs 383.64% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -78.66% vs 528.95% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -52.68% vs 366.18% in Mar 2024

YoY Growth in year ended Mar 2025 is -60.28% vs 555.81% in Mar 2024