Compare Toyam Sports with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 55 Cr (Micro Cap)

NA (Loss Making)

22

0.00%

0.00

-0.76%

0.19

Total Returns (Price + Dividend)

Toyam Sports for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

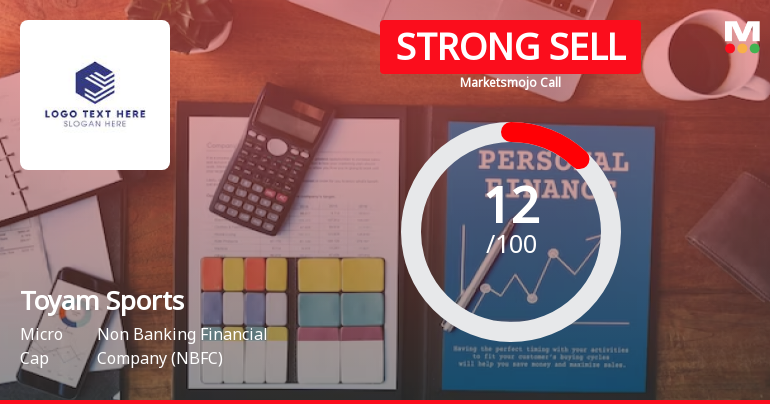

Toyam Sports Ltd is Rated Strong Sell

Toyam Sports Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 08 December 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 03 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Toyam Sports Ltd Stock Hits 52-Week Low Amidst Continued Decline

Toyam Sports Ltd, a company operating in the Non Banking Financial Company (NBFC) sector, has recorded a fresh 52-week and all-time low of Rs.0.82 today, marking a significant decline in its stock price amid ongoing financial headwinds and subdued market performance.

Read full news article

Toyam Sports Ltd Stock Hits All-Time Low Amid Steep Decline

Toyam Sports Ltd, a company operating within the Non Banking Financial Company (NBFC) sector, has reached a new all-time low of ₹0.82 per share, marking a significant milestone in its ongoing downward trajectory. This latest price point reflects a continuation of the stock’s extended period of underperformance relative to both its sector and the broader market.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Meeting Updates

19-Jan-2026 | Source : BSESubmission of revised outcome of Board Meeting in compliance with the regulation 30 of the SEBI (LODR) Regulations 2015

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

15-Jan-2026 | Source : BSESubmission of Certificate under Regulation 74 (5) of SEBI (DP) Regulations 2018

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Jan-2026 | Source : BSESubmission of News paper clipping of Unaudited Financial Results for the quatre ended September 30 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Toyam Sports Ltd has announced 1:10 stock split, ex-date: 05 Oct 15

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 1 FIIs (0.11%)

Vijaykumar Nandlal Agarwal (0.0%)

Enforcement Directorate Raipur (18.52%)

74.33%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 81.63% vs -74.74% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -113.91% vs -393.08% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -84.25% vs 13.45% in Sep 2024

Growth in half year ended Sep 2025 is -357.51% vs -327.06% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -72.87% vs 429.18% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -245.86% vs 152.84% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -75.14% vs 723.60% in Mar 2024

YoY Growth in year ended Mar 2025 is -1,110.31% vs 139.69% in Mar 2024