Compare Sarthak Metals with Similar Stocks

Dashboard

Poor long term growth as Net Sales has grown by an annual rate of -17.07% and Operating profit at -40.60% over the last 5 years

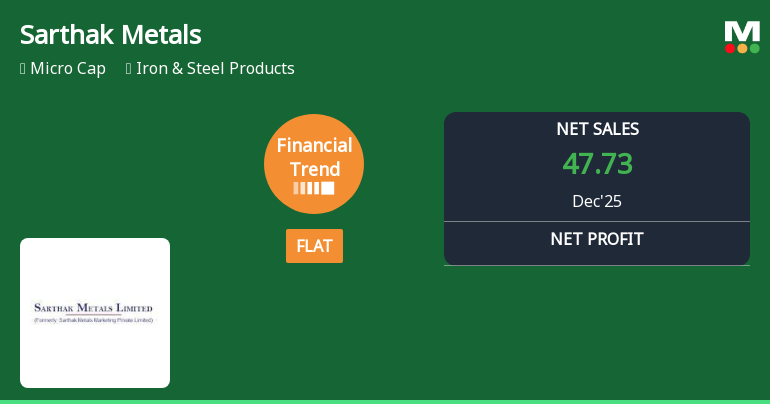

Flat results in Dec 25

With ROE of 3.1, it has a Very Expensive valuation with a 0.9 Price to Book Value

Below par performance in long term as well as near term

Stock DNA

Iron & Steel Products

INR 102 Cr (Micro Cap)

29.00

114

0.68%

-0.09

3.06%

0.83

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Jul-11-2025

Risk Adjusted Returns v/s

Returns Beta

News

Sarthak Metals Ltd Reports Flat Quarterly Performance Amid Margin Improvements

Sarthak Metals Ltd, a player in the Iron & Steel Products sector, has reported a flat financial performance for the quarter ended December 2025, signalling a stabilisation after a period of decline. While key profitability metrics such as PBDIT, PBT excluding other income, and PAT have reached their highest quarterly levels, concerns remain over the company’s return on capital employed and inventory turnover ratios, which have hit new lows in the half-year period.

Read full news article

Sarthak Metals Q3 FY26: Profit Surge Masks Deeper Structural Challenges

Sarthak Metals Ltd., a micro-cap player in the iron and steel products sector with a market capitalisation of ₹109.39 crores, reported a net profit of ₹1.30 crores for Q3 FY26, marking a robust 71.05% quarter-on-quarter growth and a 6.56% year-on-year increase. Despite this impressive quarterly performance, the stock continues to trade under significant pressure, down 47.10% over the past year and sitting 54.19% below its 52-week high of ₹174.45. The company's shares closed at ₹79.91 on February 10, 2026, reflecting a sharp 9.47% single-day gain as markets reacted to the quarterly numbers.

Read full news article

Sarthak Metals Ltd is Rated Strong Sell

Sarthak Metals Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 15 July 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 09 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article Announcements

Corporate Actions

(10 Feb 2026)

Sarthak Metals Ltd has declared 5% dividend, ex-date: 11 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 1 FIIs (0.14%)

Manoj Kumar Bansal (27.63%)

Mayur Bhatt (3.32%)

22.6%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 8.48% vs -41.57% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 6.56% vs -29.48% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -4.41% vs -45.77% in Sep 2024

Growth in half year ended Sep 2025 is -18.39% vs -79.48% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -0.06% vs -44.42% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -9.57% vs -72.62% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -41.53% vs -25.28% in Mar 2024

YoY Growth in year ended Mar 2025 is -70.21% vs -53.53% in Mar 2024