Compare Sonam with Similar Stocks

Stock DNA

Electronics & Appliances

INR 168 Cr (Micro Cap)

27.00

43

0.00%

0.30

9.38%

2.60

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Aug-19-2019

Risk Adjusted Returns v/s

Returns Beta

News

Sonam Ltd Valuation Shifts Signal Renewed Price Attractiveness Amid Mixed Returns

Sonam Ltd, a key player in the Electronics & Appliances sector, has witnessed a notable shift in its valuation parameters, moving from a very attractive to an attractive rating. This change reflects evolving market perceptions and valuation metrics, with implications for investors assessing the stock’s price attractiveness relative to its historical averages and peer group.

Read full news article

Sonam Ltd is Rated Hold by MarketsMOJO

Sonam Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 04 February 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 08 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Sonam Ltd Valuation Shifts Signal Renewed Price Attractiveness Amid Market Challenges

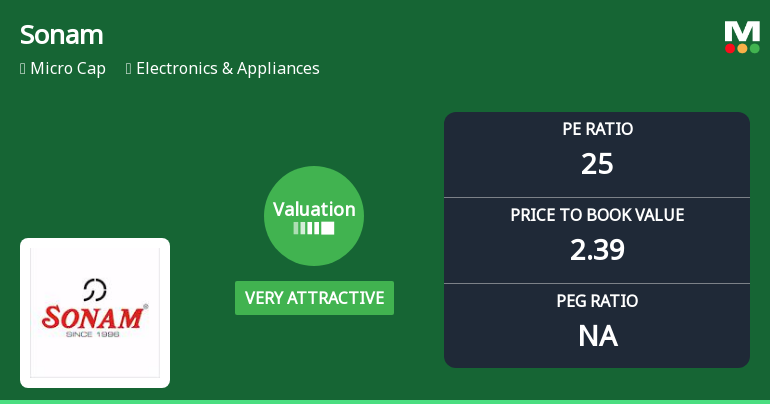

Sonam Ltd, a key player in the Electronics & Appliances sector, has witnessed a notable shift in its valuation parameters, moving from an attractive to a very attractive price range. Despite recent share price declines and a challenging market environment, the company’s improved price-to-earnings (P/E) and price-to-book value (P/BV) ratios suggest a potential revaluation opportunity for investors seeking value in a volatile sector.

Read full news article Announcements

Sonam Clock Limited - Clarification - Financial Results

18-Nov-2019 | Source : NSESonam Clock Limitedk Limited for the quarter ended 30-Sep-2019 with respect to Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Sonam Clock Limited - Outcome of Board Meeting

14-Nov-2019 | Source : NSESonam Clock Limited has informed the Exchange regarding Board meeting held on November 13, 2019. Declaration of Financial results for the half year ended as on 30/09/2019

Sonam Clock Limited - Statement of deviation(s) or variation(s) under Reg. 32

22-Oct-2019 | Source : NSESonam Clock Limited has informed the Exchange regarding Statement of deviation(s) or variation(s) under Reg. 32 of SEBI (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Sonam Ltd has declared 5% dividend, ex-date: 19 Aug 19

Sonam Ltd has announced 5:10 stock split, ex-date: 10 May 24

Sonam Ltd has announced 1:1 bonus issue, ex-date: 14 Jul 22

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

3.6668

Held by 0 Schemes

Held by 1 FIIs (0.02%)

Jayesh Chhabildas Shah (52.76%)

Arcadia Share And Stock Brokers Pvt Ltd-proprietary A/c (4.05%)

32.01%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 21.71% vs -17.25% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 144.44% vs -31.82% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 46.92% vs 12.62% in Sep 2024

Growth in half year ended Sep 2025 is -11.90% vs 29.23% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 48.39% vs 10.97% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -4.74% vs 20.83% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 18.94% vs 6.17% in Mar 2024

YoY Growth in year ended Mar 2025 is 14.67% vs 38.00% in Mar 2024