Compare Gretex Corporate with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- NET SALES(Q) At Rs 42.16 cr has Fallen at -25.7% (vs previous 4Q average)

- PBT LESS OI(Q) At Rs -1.35 cr has Fallen at -210.7% (vs previous 4Q average)

- PAT(9M) At Rs 13.83 cr has Grown at -24.84%

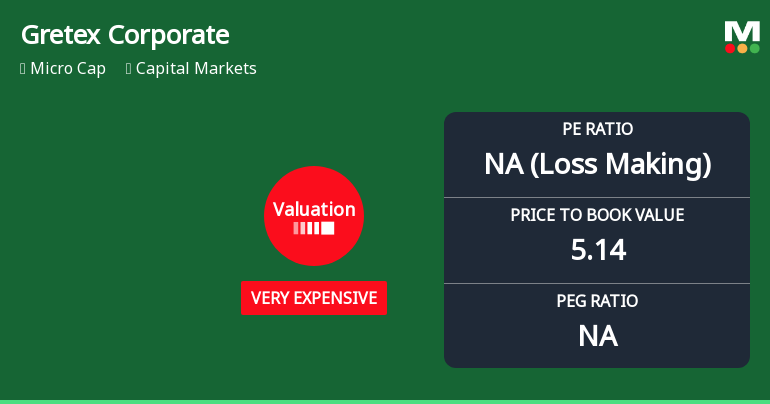

With ROE of -1, it has a Very Expensive valuation with a 5.1 Price to Book Value

Stock DNA

Capital Markets

INR 680 Cr (Micro Cap)

NA (Loss Making)

22

0.10%

0.06

-1.03%

5.14

Total Returns (Price + Dividend)

Latest dividend: 0.3 per share ex-dividend date: Aug-01-2025

Risk Adjusted Returns v/s

Returns Beta

News

Gretex Corporate Services Ltd Downgraded to Strong Sell Amid Valuation and Financial Concerns

Gretex Corporate Services Ltd has been downgraded from a Sell to a Strong Sell rating as of 2 February 2026, reflecting deteriorating fundamentals and stretched valuation metrics. The downgrade follows a comprehensive reassessment across four key parameters: quality, valuation, financial trend, and technicals, signalling heightened risks for investors in the capital markets sector.

Read full news article

Gretex Corporate Services Ltd Valuation Shifts Signal Heightened Price Risk

Gretex Corporate Services Ltd, a player in the Capital Markets sector, has seen its valuation metrics deteriorate sharply, moving from an already expensive rating to a very expensive classification. Despite a modest day gain of 0.73%, the company’s price-to-earnings (P/E) ratio has plunged to a negative -217.19, signalling deep earnings challenges. This shift, coupled with a price-to-book value (P/BV) of 5.14, places Gretex at a significant premium compared to historical and peer averages, raising questions about its price attractiveness for investors.

Read full news article

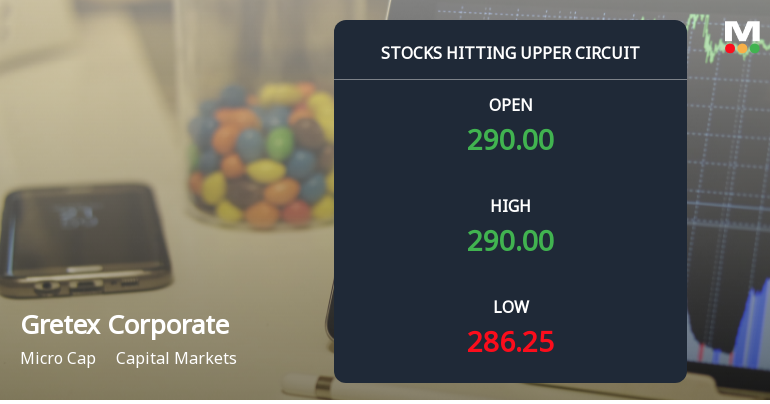

Gretex Corporate Services Ltd Hits Upper Circuit Amid Strong Buying Pressure

Gretex Corporate Services Ltd, a micro-cap player in the Capital Markets sector, surged to hit its upper circuit price limit on 2 Feb 2026, reflecting robust buying interest despite a backdrop of falling investor participation and mixed technical signals. The stock closed at ₹310.45, marking a maximum daily gain of 4.99%, underscoring a significant shift in market sentiment towards the company.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

Gretex Corporate Services Ltd has declared 3% dividend, ex-date: 01 Aug 25

No Splits history available

Gretex Corporate Services Ltd has announced 9:10 bonus issue, ex-date: 09 Apr 25

Gretex Corporate Services Ltd has announced 1:8 rights issue, ex-date: 23 Aug 23

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 3 FIIs (1.23%)

Bonanza Agency Llp (44.88%)

Anupam Gupta (2.87%)

20.9%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -47.01% vs 261.97% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -85.94% vs 1,387.01% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -23.82% vs 1,070.24% in Sep 2024

Growth in half year ended Sep 2025 is -18.21% vs 429.79% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -27.79% vs 271.60% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -24.84% vs 315.35% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 137.51% vs 762.95% in Mar 2024

YoY Growth in year ended Mar 2025 is -95.21% vs 316.41% in Mar 2024