Compare Nidan Laborator. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength as the company has not declared results in the last 6 months

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.36 times

- The company has been able to generate a Return on Capital Employed (avg) of 9.06% signifying low profitability per unit of total capital (equity and debt)

Flat results in Sep 21

Risky - No result in last 6 months

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Nidan Laborator. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

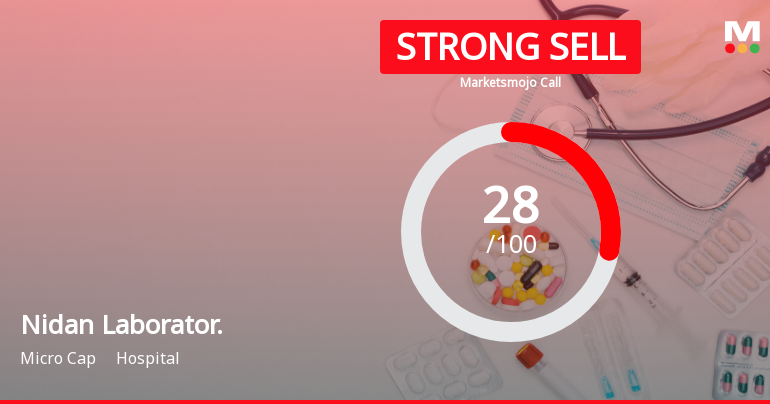

Nidan Laboratories & Healthcare Ltd is Rated Strong Sell

Nidan Laboratories & Healthcare Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 22 September 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 26 December 2025, providing investors with the most up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article

Nidan Laborator. Evaluation Revised Amid Mixed Financial and Technical Signals

Nidan Laborator., a microcap player in the hospital sector, has undergone a revision in its market assessment reflecting shifts in its fundamental and technical outlook. This update highlights nuanced changes across quality, valuation, financial trends, and technical indicators, providing investors with a clearer understanding of the stock’s current positioning within a challenging market environment.

Read full news article

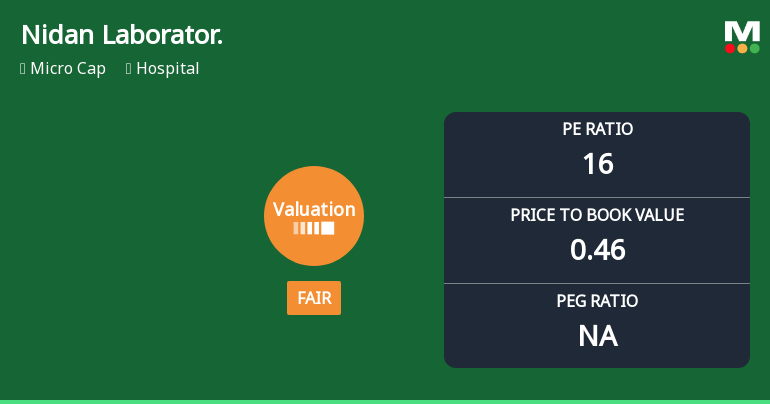

Nidan Laboratories & Healthcare: Valuation Metrics Reflect Shift in Market Assessment

Nidan Laboratories & Healthcare has experienced a notable revision in its valuation parameters, with key metrics such as the price-to-earnings (P/E) ratio and price-to-book value (P/BV) indicating a shift from previously attractive levels to a more moderate assessment. This article examines these changes in the context of the hospital sector and peer comparisons, providing insight into the stock’s current market positioning.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Nitin Vitthalrao Thorve (50.15%)

Devendra Rajnikant Ladhan (1.08%)

40.05%

Quarterly Results Snapshot (Standalone) - Sep'21 - QoQ

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period