Compare The Peria Karama with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -21.89% CAGR growth in Operating Profits over the last 5 years

- The company has been able to generate a Return on Equity (avg) of 1.88% signifying low profitability per unit of shareholders funds

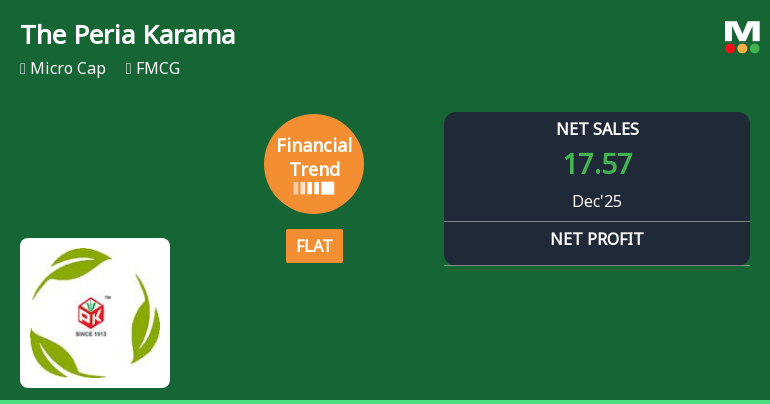

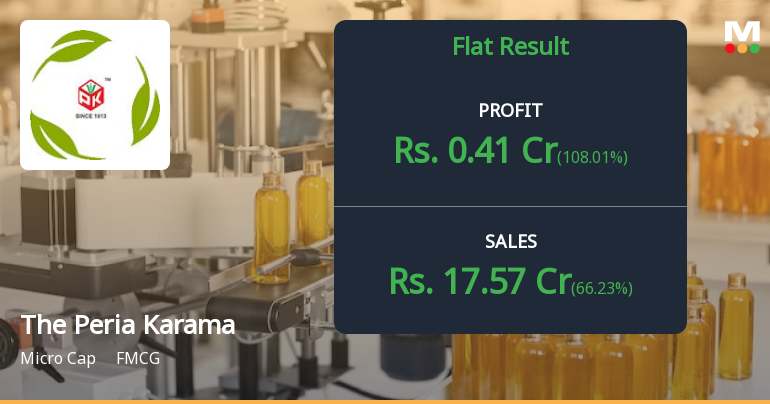

Flat results in Dec 25

With ROE of 2.8, it has a Very Expensive valuation with a 1.1 Price to Book Value

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Sep-12-2025

Risk Adjusted Returns v/s

Returns Beta

News

The Peria Karamalai Tea & Produce Company Ltd Reports Stabilised Quarterly Performance Amid Margin Pressures

The Peria Karamalai Tea & Produce Company Ltd has reported a flat financial performance for the quarter ended December 2025, signalling a stabilisation after a period of negative trends. While net sales reached a quarterly high of ₹17.57 crores and profit before tax excluding other income surged by nearly 291%, the company continues to grapple with a low return on capital employed and a significant proportion of profits derived from non-operating income. This mixed performance has led to an upgrade in the company’s Mojo Grade from Sell to Strong Sell, reflecting cautious optimism amid ongoing challenges.

Read full news articleAre The Peria Karamalai Tea & Produce Company Ltd latest results good or bad?

The Peria Karamalai Tea & Produce Company Ltd's latest financial results for Q3 FY26 indicate a complex operational landscape. The company reported net sales of ₹17.57 crores, which reflects a significant year-on-year increase of 30.43%. This marks a quarterly high and shows a notable recovery from previous periods. However, the quality of earnings remains a concern, as the net profit of ₹0.88 crores is heavily influenced by non-operating income, which accounted for a substantial portion of profitability. Operating margins, excluding other income, improved to 11.13%, up from 6.96% in the same quarter last year, suggesting some operational recovery. Nonetheless, this improvement follows a history of operating losses, raising questions about sustainability. The company's return on equity (ROE) remains low at 1.88%, indicating challenges in capital utilization and operational efficiency. Over the nine-month ...

Read full news article

The Peria Karamalai Tea Q3 FY26: Exceptional Other Income Masks Weak Core Operations

The Peria Karamalai Tea & Produce Company Ltd., a century-old tea producer with estates in high-yielding zones, delivered a mixed performance in Q3 FY26, with net profit surging to ₹0.88 crores compared to ₹0.03 crores in the year-ago quarter. However, the impressive bottom-line growth conceals troubling operational weakness, as the company's core tea business continues to struggle with negative operating margins. The stock, currently trading at ₹692.00 with a market capitalisation of ₹220.00 crores, has underperformed the broader market with a 21.55% decline year-to-date.

Read full news article Announcements

The Peria Karamalai Tea & Produce Company Limited - Other General Purpose

13-Nov-2019 | Source : NSEThe Peria Karamalai Tea & Produce Company Limited has informed the Exchange regarding Disclosure of related party transactions pursuant to Regulation 23(9) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Shareholders meeting

23-Sep-2019 | Source : NSE

| The Peria Karamalai Tea & Produce Company Limited has informed the Exchange with copy of minutes of Annual General Meeting held on September 09, 2019 |

Shareholders meeting

10-Sep-2019 | Source : NSE

| The Peria Karamalai Tea & Produce Company Limited has submitted the Exchange a copy Srutinizers report of Annual General Meeting held on September 09, 2019. Further, the company has informed the Exchange regarding voting results. |

Corporate Actions

No Upcoming Board Meetings

The Peria Karamalai Tea & Produce Company Ltd has declared 10% dividend, ex-date: 12 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Placid Limited (38.8%)

Mahendra Girdharilal (3.73%)

20.85%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 66.23% vs -36.59% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 108.01% vs -165.22% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -3.27% vs 15.84% in Sep 2024

Growth in half year ended Sep 2025 is -62.29% vs 772.29% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 10.37% vs -3.56% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -13.02% vs 118.79% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -5.83% vs 4.19% in Mar 2024

YoY Growth in year ended Mar 2025 is -95.51% vs 258.93% in Mar 2024