Dashboard

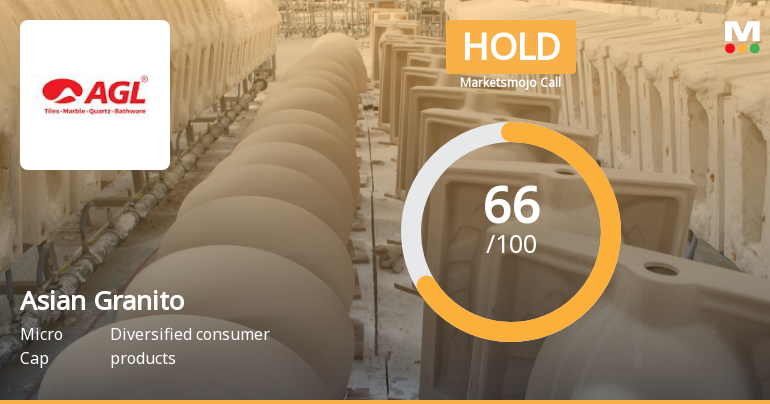

Weak Long Term Fundamental Strength with a -7.88% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 0.97

- The company has been able to generate a Return on Equity (avg) of 3.98% signifying low profitability per unit of shareholders funds

With a growth in Net Profit of 254.99%, the company declared Very Positive results in Sep 25

With ROCE of 2.7, it has a Very Attractive valuation with a 1.2 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0% of the company

Stock DNA

Diversified consumer products

INR 1,731 Cr (Micro Cap)

55.00

29

0.00%

0.17

2.21%

1.23

Total Returns (Price + Dividend)

Latest dividend: 0.7 per share ex-dividend date: Jun-09-2022

Risk Adjusted Returns v/s

Returns Beta

News

Asian Granito India Hits New 52-Week High at Rs.76.93

Asian Granito India has reached a significant milestone by touching a new 52-week high of Rs.76.93, reflecting notable momentum in the stock’s performance within the diversified consumer products sector.

Read More

Asian Granito India Hits New 52-Week High of Rs.75.2, Marking Strong Market Momentum

Asian Granito India has reached a significant milestone by touching a new 52-week high of Rs.75.2, reflecting sustained momentum in the stock over recent sessions. This achievement underscores the stock’s robust performance within the diversified consumer products sector amid a broadly positive market environment.

Read More

Asian Granito’s Evaluation Revised Amid Mixed Financial Signals and Market Momentum

Asian Granito has experienced a revision in its evaluation metrics, reflecting a nuanced shift in its financial and market profile. This change comes amid a backdrop of strong recent quarterly results, attractive valuation levels, and a bullish technical outlook, despite ongoing challenges in long-term profitability and fundamental strength.

Read More Announcements

Asian Granito India Limited - Updates

09-Dec-2019 | Source : NSEAsian Granito India Limited has informed the Exchange regarding 'Disclosure of Related Party Transactions for the half year ended September 30. 2019 pursuant to Regulation 23(9) of the SEBI (Listing Obligations and Disclosure Requirements) Regulation. 2015 ('the Listing Regulations'). '.

Asian Granito India Limited - Analysts/Institutional Investor Meet/Con. Call Updates

18-Nov-2019 | Source : NSEAsian Granito India Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Asian Granito India Limited - Press Release

13-Nov-2019 | Source : NSEAsian Granito India Limited has informed the Exchange regarding a press release dated November 12, 2019, titled "Asian Granito India Limited announces Financial Results for Second Quarter ended September, 2019".

Corporate Actions

No Upcoming Board Meetings

Asian Granito India Ltd has declared 7% dividend, ex-date: 09 Jun 22

No Splits history available

No Bonus history available

Asian Granito India Ltd has announced 37:30 rights issue, ex-date: 11 Apr 22

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 17 FIIs (1.1%)

Kamleshkumar Bhagubhai Patel (5.27%)

Hiren Pranjivanbhai Patel (3.04%)

57.74%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 6.06% vs -4.30% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 151.00% vs 615.08% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 9.39% vs -1.20% in Sep 2024

Growth in half year ended Sep 2025 is 184.89% vs 325.41% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -1.81% vs -0.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 186.88% vs 64.61% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 6.37% vs -2.06% in Mar 2024

YoY Growth in year ended Mar 2025 is 111.18% vs 83.15% in Mar 2024