Compare Ortel Commu. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength as the company has not declared results in the last 6 months

- Poor long term growth as Net Sales has grown by an annual rate of -21.19% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

With a fall in Operating Profit of -1497.85%, the company declared Very Negative results in Jun 21

Risky - No result in last 6 months

Stock DNA

Media & Entertainment

INR 5 Cr (Micro Cap)

NA (Loss Making)

18

0.00%

-2.22

28.44%

-0.06

Total Returns (Price + Dividend)

Risk Adjusted Returns v/s

Returns Beta

News

Ortel Communications Ltd is Rated Strong Sell

Ortel Communications Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 08 Mar 2022. However, the analysis and financial metrics presented here reflect the stock's current position as of 26 December 2025, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article

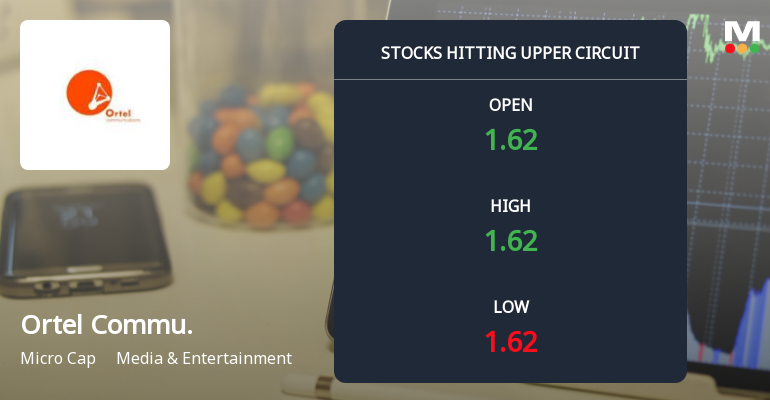

Ortel Communications Hits Upper Circuit Amid Strong Buying Pressure

Ortel Communications Ltd, a micro-cap player in the Media & Entertainment sector, witnessed its stock price hit the upper circuit limit on 15 Dec 2025, reflecting robust buying interest and a maximum permissible daily gain of 5.00%. This price action underscores heightened market attention despite subdued trading volumes and regulatory restrictions on further transactions.

Read full news article

Ortel Communications Hits Upper Circuit Amid Strong Buying Pressure

Ortel Communications Ltd witnessed a significant surge in its share price on 12 Dec 2025, hitting the upper circuit limit of 4.52% to close at ₹1.62. This movement reflects robust buying interest in the micro-cap stock within the Media & Entertainment sector, accompanied by a regulatory freeze on further trading, underscoring the stock’s heightened demand and limited supply on the bourse.

Read full news article Announcements

Ortel Communications Limited - Updates

16-Oct-2019 | Source : NSEOrtel Communications Limited has informed the Exchange regarding 'Certificate in compliance with Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 of Ortel Communications Ltd (under CIRP) for the quarter ended 30th September, 2019 of FY 2019-20'.

Updates

05-Sep-2019 | Source : NSE

| Ortel Communications Limited has informed the Exchange regarding 'Intimation of Newspaper Advertisement regarding Annual General Meeting, Book Closure and E-voting Information of the Company to be held on Saturday, 28th September, 2019 at 10:30 A.M. at Modi Hall, PHD Chamber of Commerce and Industry, PHD House, 4/2, Siri Institutional Area, August Kranti Marg, New Delhi-110016.'. |

AGM\/Book Closure

05-Sep-2019 | Source : NSE

| Ortel Communications Limited has informed the Exchange that the Company has fixed Book Closure from September 21, 2019 to September 28, 2019 for the purpose of Annual General Meeting |

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Jun 2020

Shareholding Compare (%holding)

Promoters

13.6758

Held by 0 Schemes

Held by 6 FIIs (9.24%)

Metro Skynet Ltd (14.74%)

Elizabeth Mathew . (4.36%)

28.63%

Quarterly Results Snapshot (Consolidated) - Jun'21 - QoQ

QoQ Growth in quarter ended Jun 2021 is -28.68% vs -10.05% in Mar 2021

QoQ Growth in quarter ended Jun 2021 is -12.17% vs -30.91% in Mar 2021

Half Yearly Results Snapshot (Consolidated) - Sep'20

Growth in half year ended Sep 2020 is -16.41% vs -29.69% in Sep 2019

Growth in half year ended Sep 2020 is 62.47% vs 37.38% in Sep 2019

Nine Monthly Results Snapshot (Consolidated) - Dec'20

YoY Growth in nine months ended Dec 2020 is -18.81% vs -25.69% in Dec 2019

YoY Growth in nine months ended Dec 2020 is 48.20% vs 39.83% in Dec 2019

Annual Results Snapshot (Consolidated) - Mar'21

YoY Growth in year ended Mar 2021 is -21.24% vs -21.95% in Mar 2020

YoY Growth in year ended Mar 2021 is 37.01% vs 31.95% in Mar 2020