Compare Walmart, Inc. with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 23.53%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.91 times

Poor long term growth as Operating profit has grown by an annual rate 3.28% of over the last 5 years

The company has declared Positive results for the last 4 consecutive quarters

With ROCE of 24.10%, it has a very expensive valuation with a 6.66 Enterprise value to Capital Employed

High Institutional Holdings at 36.05%

Total Returns (Price + Dividend)

Walmart, Inc. for the last several years.

Risk Adjusted Returns v/s

News

Walmart, Inc. Experiences Revision in Its Stock Evaluation Amid Competitive Retail Landscape

Walmart, Inc. has adjusted its valuation, showcasing a P/E ratio of 37 and a strong return on capital employed at 24.10%. Compared to peers like Costco, Walmart maintains a competitive position in the retail sector, despite facing challenges in longer-term stock performance.

Read full news article

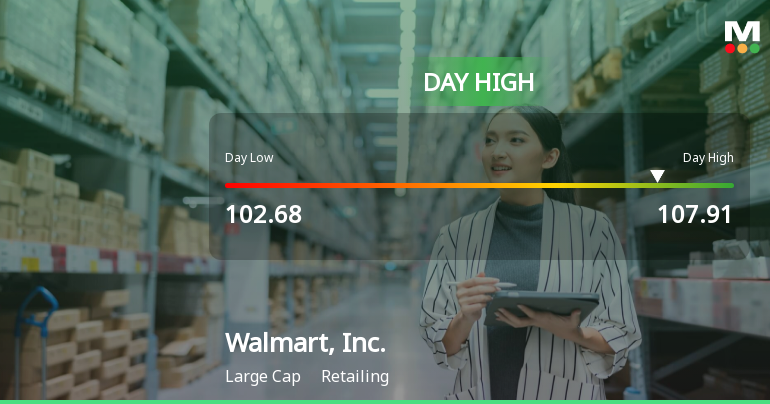

Walmart Stock Soars to Day High with 6.46% Intraday Gain

Walmart, Inc. has seen notable stock performance, gaining 6.46% on November 20, 2025, and reaching an intraday high of USD 107.91. Over the past year, the company has increased by 22.86%, demonstrating resilience in the retail sector with strong financial metrics and a substantial market capitalization.

Read full news article

Walmart, Inc. Experiences Revision in Its Stock Evaluation Amid Strong Market Performance

Walmart, Inc. has recently adjusted its valuation, showcasing a P/E ratio of 37 and a price-to-book value of 9.31. The company demonstrates strong financial metrics, including a ROCE of 24.10% and a ROE of 25.26%, reflecting its competitive position in the retail sector.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Oct 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 243 Schemes (12.49%)

Held by 682 Foreign Institutions (6.96%)

Quarterly Results Snapshot (Consolidated) - Oct'25 - YoY

YoY Growth in quarter ended Oct 2025 is 5.84% vs 5.46% in Oct 2024

YoY Growth in quarter ended Oct 2025 is 29.15% vs 633.13% in Oct 2024

Annual Results Snapshot (Consolidated) - Jan'25

YoY Growth in year ended Jan 2025 is 5.07% vs 6.03% in Jan 2024

YoY Growth in year ended Jan 2025 is 23.89% vs 44.08% in Jan 2024