Compare Steel Partners Holdings LP with Similar Stocks

Total Returns (Price + Dividend)

Steel Partners Holdings LP for the last several years.

Risk Adjusted Returns v/s

News

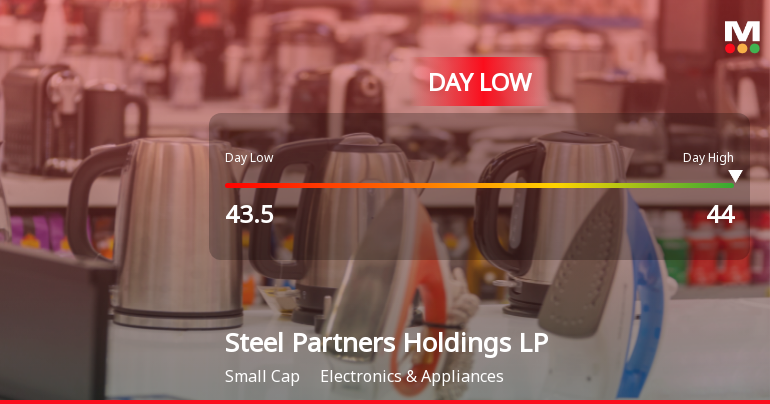

Steel Partners Holdings LP Hits Day Low of $43.50 Amid Price Pressure

Steel Partners Holdings LP saw a notable decline in its stock price, contrasting with the S&P 500's modest decrease. Despite recent challenges, the company has shown resilience with positive long-term growth indicators, including a strong return on equity and significant operating profit growth, maintaining a premium valuation in its sector.

Read full news article

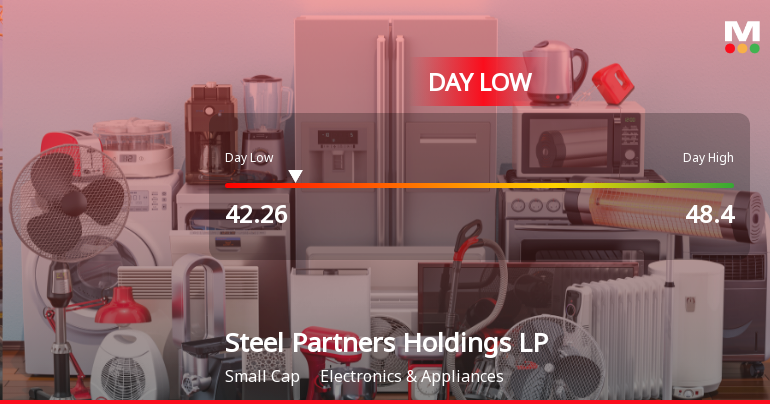

Steel Partners Holdings LP Hits Day Low of $42.26 Amid Price Pressure

Steel Partners Holdings LP faced a notable decline in its stock price today, reaching an intraday low. Despite this downturn, the company has shown positive performance over the past month and maintains a strong market position in the Electronics & Appliances industry, supported by solid financial metrics.

Read full news article

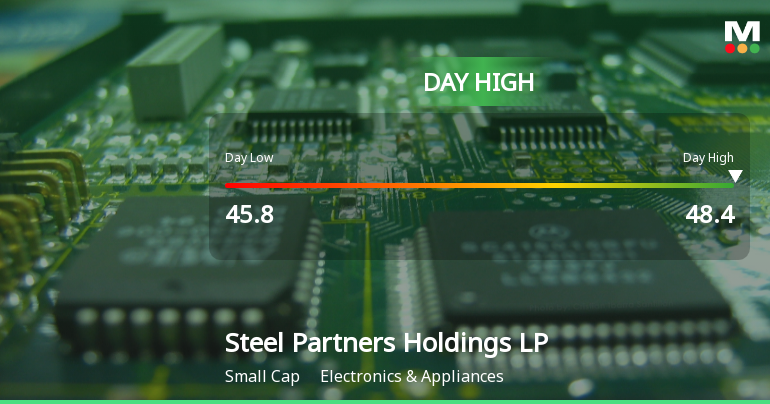

Steel Partners Holdings LP Surges to Intraday High with 11.91% Gain

Steel Partners Holdings LP recorded a strong intraday performance on 23 Dec 2025, surging 11.91% to touch a day’s high of USD 48.40, significantly outperforming the S&P 500 index which rose 0.64% on the same day.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 1 Schemes (3.11%)

Held by 2 Foreign Institutions (0.15%)

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -1.60% vs 10.59% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -7.29% vs 163.92% in Jun 2025

Annual Results Snapshot (Consolidated) - Dec'24

YoY Growth in year ended Dec 2024 is 6.38% vs 12.46% in Dec 2023

YoY Growth in year ended Dec 2024 is 76.10% vs -25.32% in Dec 2023