Compare AeroVironment, Inc. with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROE of 5.03%

- The company has been able to generate a Return on Equity (avg) of 5.03% signifying low profitability per unit of shareholders funds

Poor long term growth as Operating profit has grown by an annual rate 4.48% of over the last 5 years

Negative results in Jul 25

Risky -

Total Returns (Price + Dividend)

AeroVironment, Inc. for the last several years.

Risk Adjusted Returns v/s

News

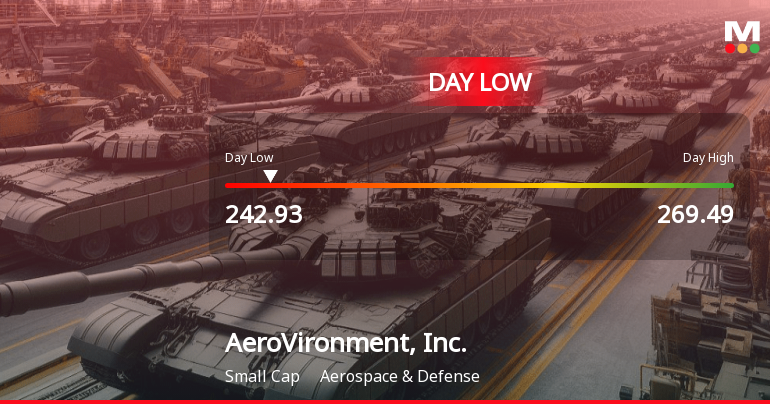

AeroVironment Stock Hits Day Low of $242.93 Amid Price Pressure

AeroVironment, Inc. faced a notable stock decline today, reaching an intraday low amid a challenging trading environment. Despite a strong annual performance, recent weeks have shown significant decreases. Financial metrics reveal concerns, including low Return on Equity and negative operating cash flow, alongside rising raw material costs.

Read full news article

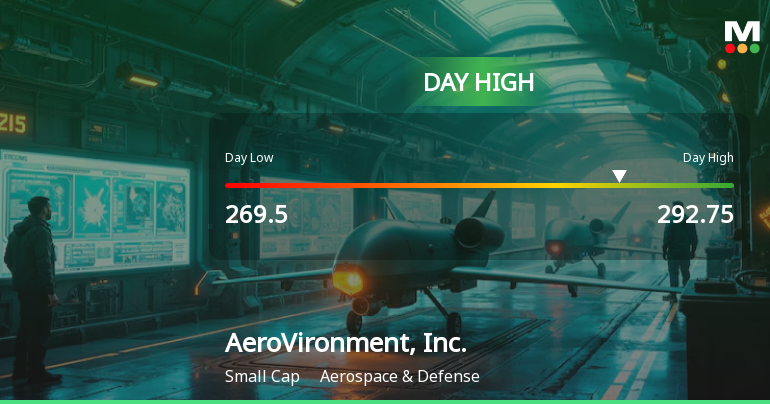

AeroVironment Stock Soars 8.49% to Intraday High Amid Strong Performance

AeroVironment, Inc. has seen a significant rise in its stock price, outperforming the broader market. Despite recent gains, the company faces challenges, including a decline over the past month and low return on equity. Financial metrics reveal concerns, particularly regarding cash flow and valuation.

Read full news article

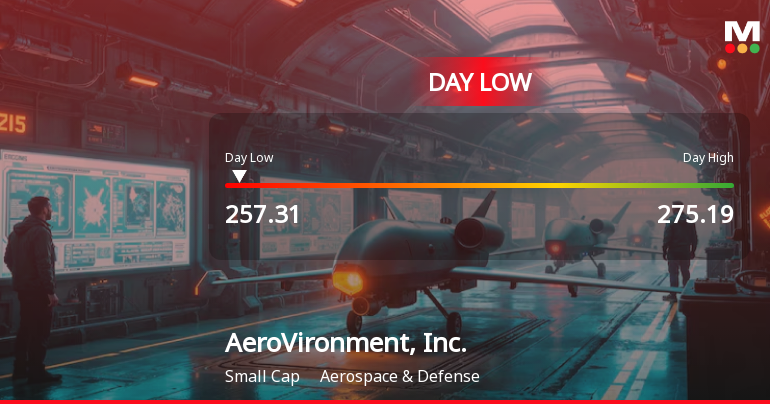

AeroVironment Stock Hits Day Low of $257.31 Amid Price Pressure

AeroVironment, Inc. faced a notable stock decline today, reflecting ongoing financial challenges. The company has struggled with negative results in recent quarters, low profitability metrics, and significant cash flow issues. Rising raw material costs further complicate its financial outlook, contrasting with the modest gains of the broader market.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Oct 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 104 Schemes (35.08%)

Held by 195 Foreign Institutions (12.58%)

Quarterly Results Snapshot (Consolidated) - Apr'25 - YoY

YoY Growth in quarter ended Apr 2025 is 39.64% vs 5.91% in Apr 2024

YoY Growth in quarter ended Apr 2025 is 178.33% vs 103.74% in Apr 2024

Annual Results Snapshot (Consolidated) - Apr'25

YoY Growth in year ended Apr 2025 is 14.50% vs 32.60% in Apr 2024

YoY Growth in year ended Apr 2025 is -26.97% vs 133.88% in Apr 2024